Weak Form Efficiency - The random walk theory states that market and securities prices are random and not influenced. What is the random walk theory? What is weak form efficiency? How does market efficiency work? The random walk theory states that market and securities prices are random and not influenced. In general, there are two kinds of market efficiency. Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands

Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands How does market efficiency work? What is the random walk theory? What is weak form efficiency? The random walk theory states that market and securities prices are random and not influenced. In general, there are two kinds of market efficiency. The random walk theory states that market and securities prices are random and not influenced.

The random walk theory states that market and securities prices are random and not influenced. What is weak form efficiency? The random walk theory states that market and securities prices are random and not influenced. What is the random walk theory? How does market efficiency work? In general, there are two kinds of market efficiency. Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands

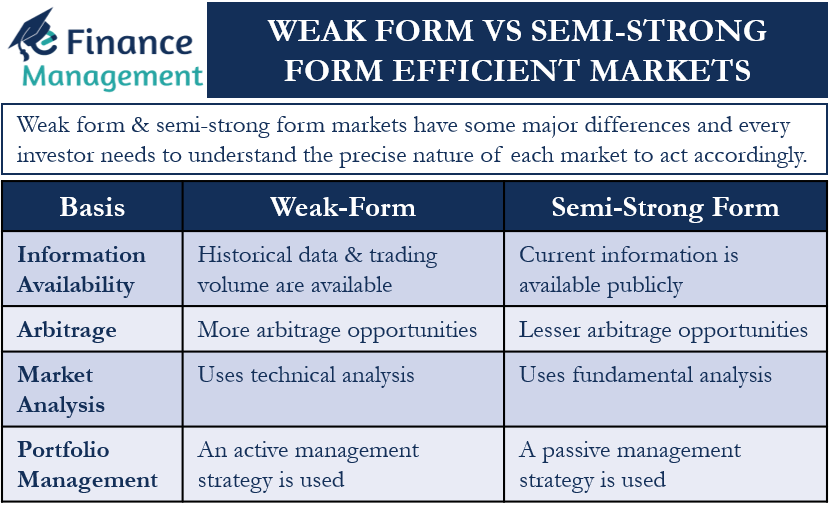

WeakForm vs SemiStrong Form Efficient Markets eFM

The random walk theory states that market and securities prices are random and not influenced. Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands In general, there are two kinds of market efficiency. How does market efficiency work? The random walk theory states that market and securities prices are random and not influenced.

PPT The Efficient Market Hypothesis PowerPoint Presentation, free

What is the random walk theory? What is weak form efficiency? The random walk theory states that market and securities prices are random and not influenced. Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands The random walk theory states that market and securities prices are random and not influenced.

Weak Form Efficiency What It Is, Examples, Vs SemiStrong Form

What is weak form efficiency? The random walk theory states that market and securities prices are random and not influenced. Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands How does market efficiency work? What is the random walk theory?

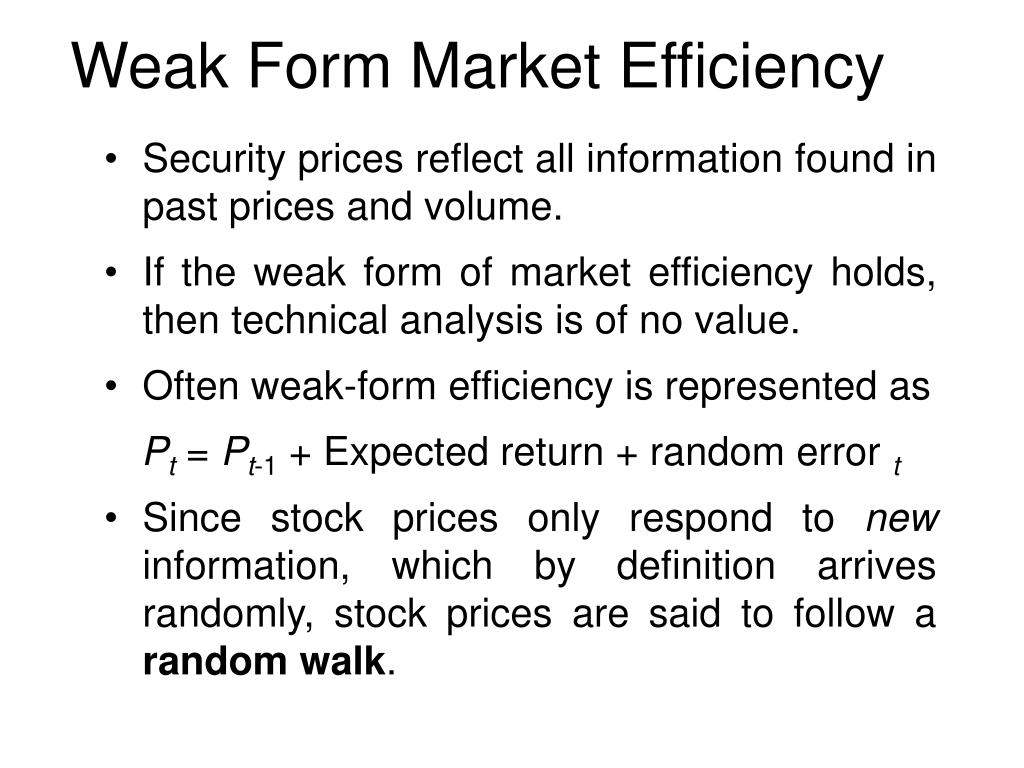

PPT XI. MARKET EFFICIENCY PowerPoint Presentation, free download ID

Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands The random walk theory states that market and securities prices are random and not influenced. The random walk theory states that market and securities prices are random and not influenced. In general, there are two kinds of market efficiency. What is the random walk theory?

PPT Capital Markets and The Efficient Market Hypothesis PowerPoint

What is weak form efficiency? How does market efficiency work? The random walk theory states that market and securities prices are random and not influenced. The random walk theory states that market and securities prices are random and not influenced. In general, there are two kinds of market efficiency.

Lecture 8 Corporate Financing Decisions and Efficient Markets. ppt

The random walk theory states that market and securities prices are random and not influenced. The random walk theory states that market and securities prices are random and not influenced. What is the random walk theory? Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands What is weak form efficiency?

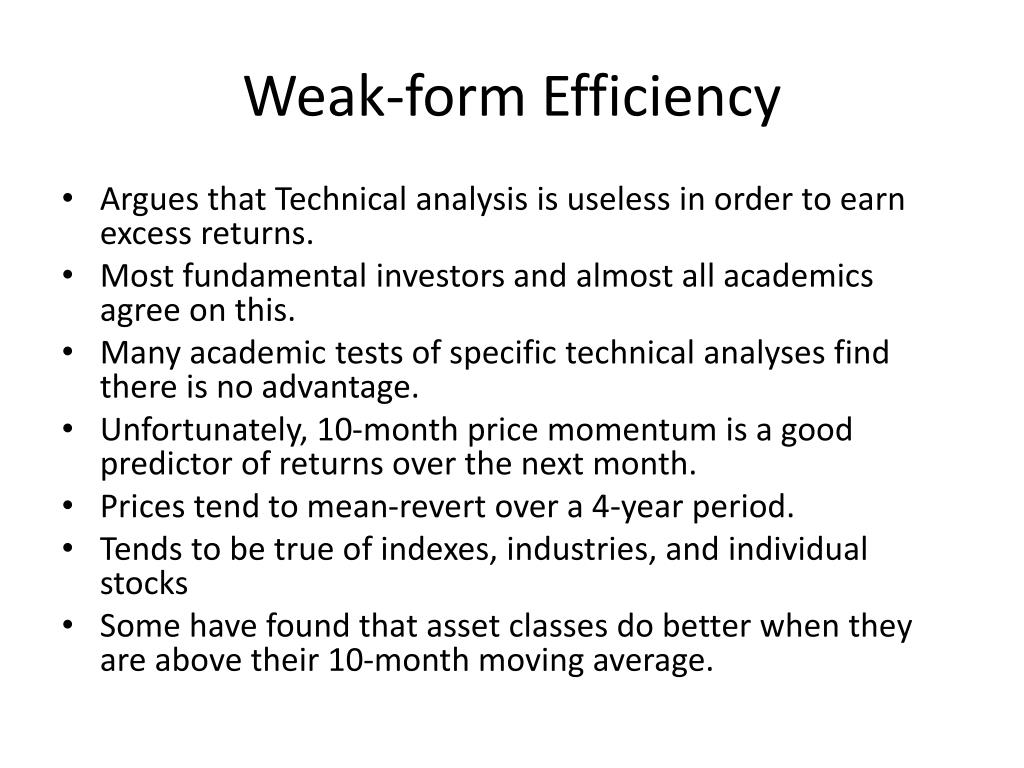

PPT CHAPTER ONE PowerPoint Presentation, free download ID1960979

How does market efficiency work? The random walk theory states that market and securities prices are random and not influenced. What is the random walk theory? In general, there are two kinds of market efficiency. Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands

PPT Efficient Market Hypothesis Reference RWJ Chp 13 PowerPoint

How does market efficiency work? Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands In general, there are two kinds of market efficiency. The random walk theory states that market and securities prices are random and not influenced. What is weak form efficiency?

PPT T he Efficient Markets Hypothesis Explained, Demythologized

How does market efficiency work? Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands What is the random walk theory? In general, there are two kinds of market efficiency. The random walk theory states that market and securities prices are random and not influenced.

PPT Stocks and Their Valuation PowerPoint Presentation, free download

How does market efficiency work? Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands The random walk theory states that market and securities prices are random and not influenced. The random walk theory states that market and securities prices are random and not influenced. In general, there are two kinds of market efficiency.

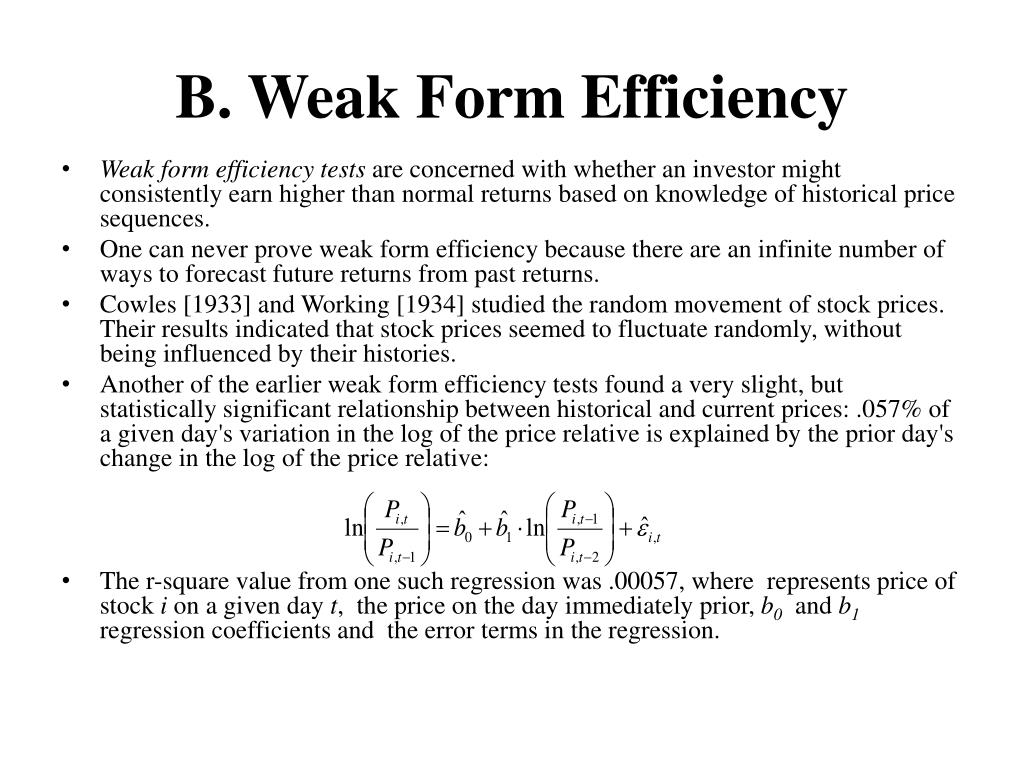

The Random Walk Theory States That Market And Securities Prices Are Random And Not Influenced.

In general, there are two kinds of market efficiency. Waterfall concept waterfall payment wave weak currency weak dollar weak form efficiency weak hands The random walk theory states that market and securities prices are random and not influenced. What is the random walk theory?

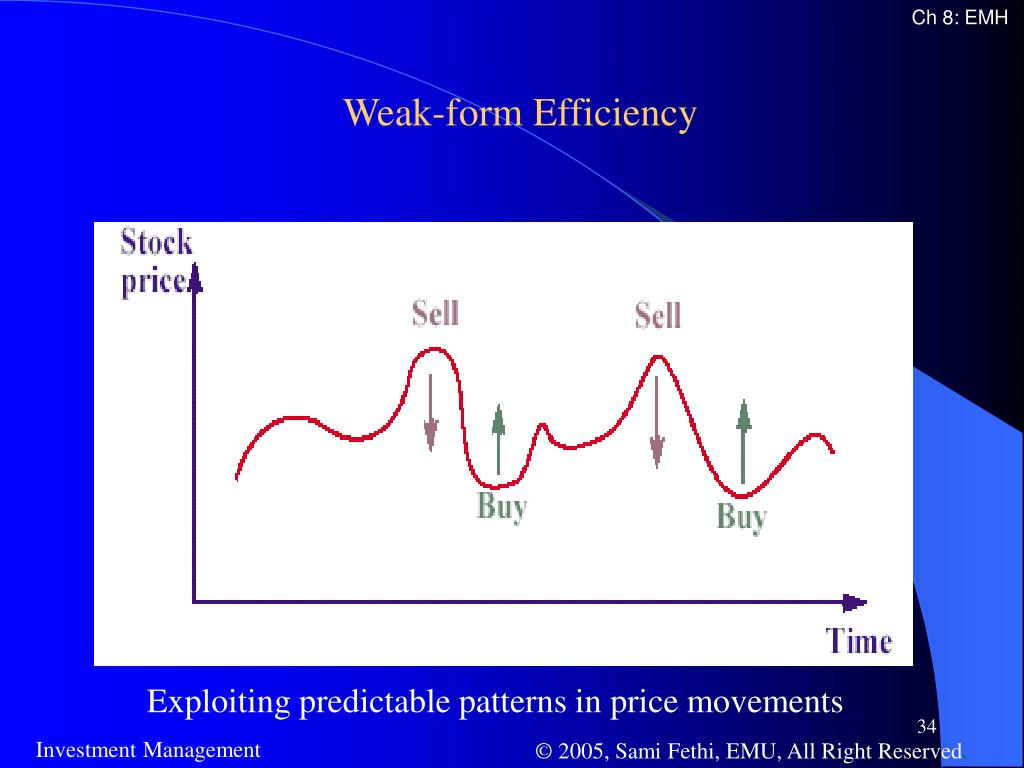

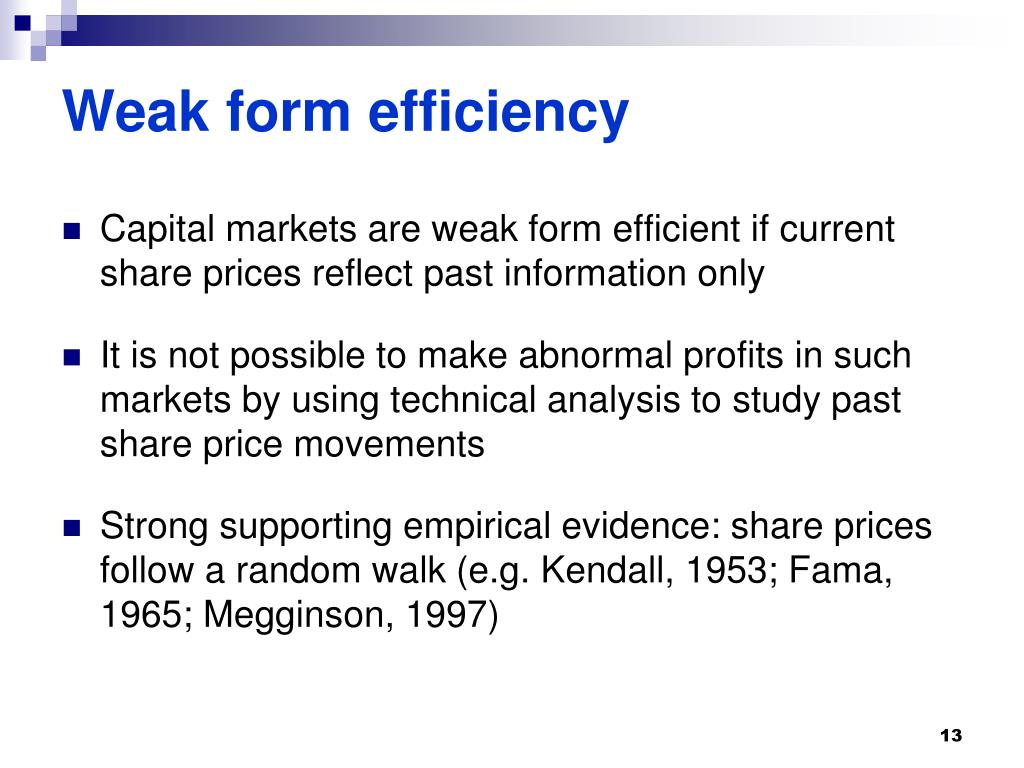

What Is Weak Form Efficiency?

How does market efficiency work?

.jpg)