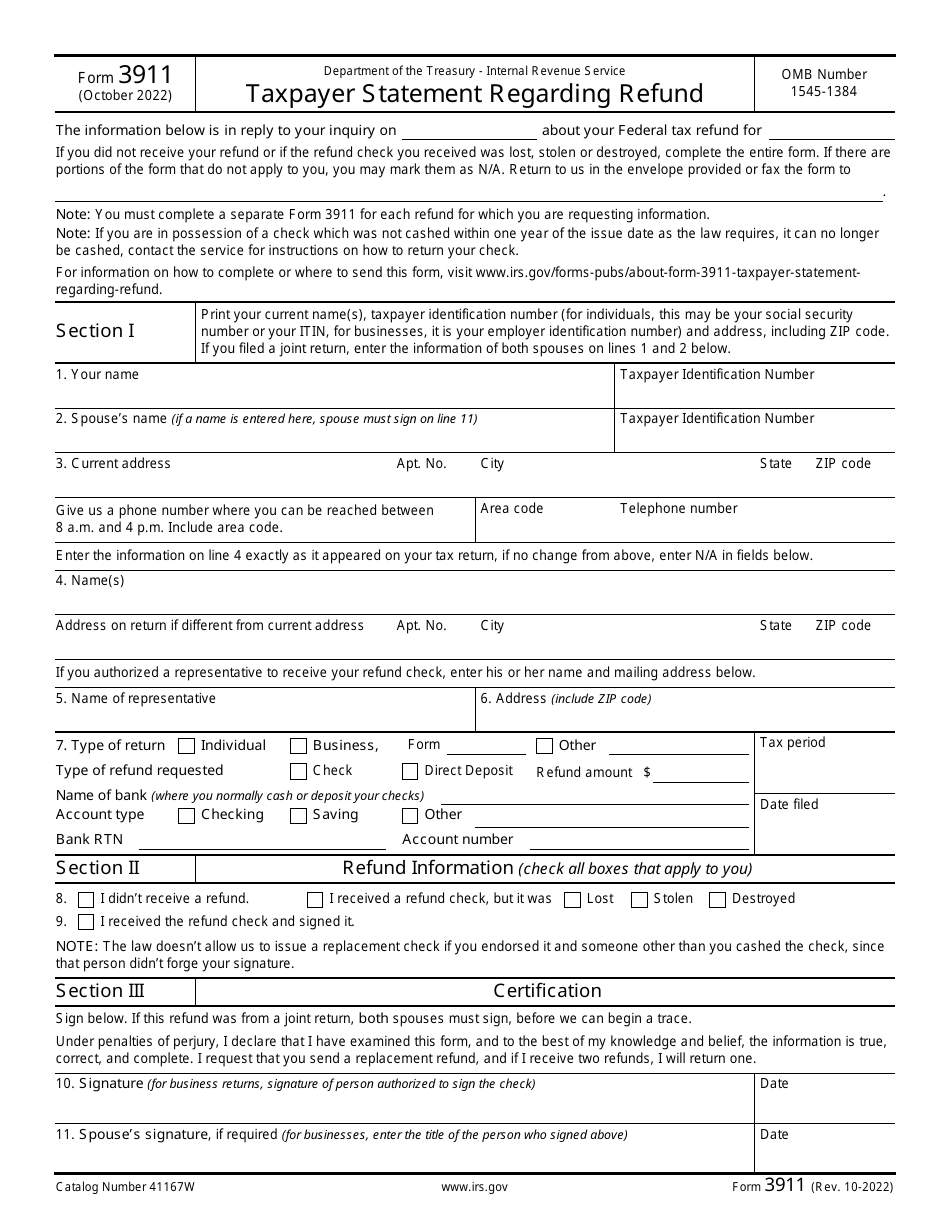

Tax Form 3911 - Do not send this form to this office. Information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on. Call and speak with a representative to get the process started or download and complete form 3911, taxpayer statement regarding refund. Instead, please use the envelope provided or mail the form to the internal revenue service center where you would. Once the appropriate time has passed, taxpayers can request a refund trace by submitting irs form 3911, taxpayer statement regarding. If your filing status is married filing jointly, you need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs.

Do not send this form to this office. Information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on. Instead, please use the envelope provided or mail the form to the internal revenue service center where you would. Once the appropriate time has passed, taxpayers can request a refund trace by submitting irs form 3911, taxpayer statement regarding. If your filing status is married filing jointly, you need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs. Call and speak with a representative to get the process started or download and complete form 3911, taxpayer statement regarding refund.

Call and speak with a representative to get the process started or download and complete form 3911, taxpayer statement regarding refund. Information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on. If your filing status is married filing jointly, you need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs. Do not send this form to this office. Once the appropriate time has passed, taxpayers can request a refund trace by submitting irs form 3911, taxpayer statement regarding. Instead, please use the envelope provided or mail the form to the internal revenue service center where you would.

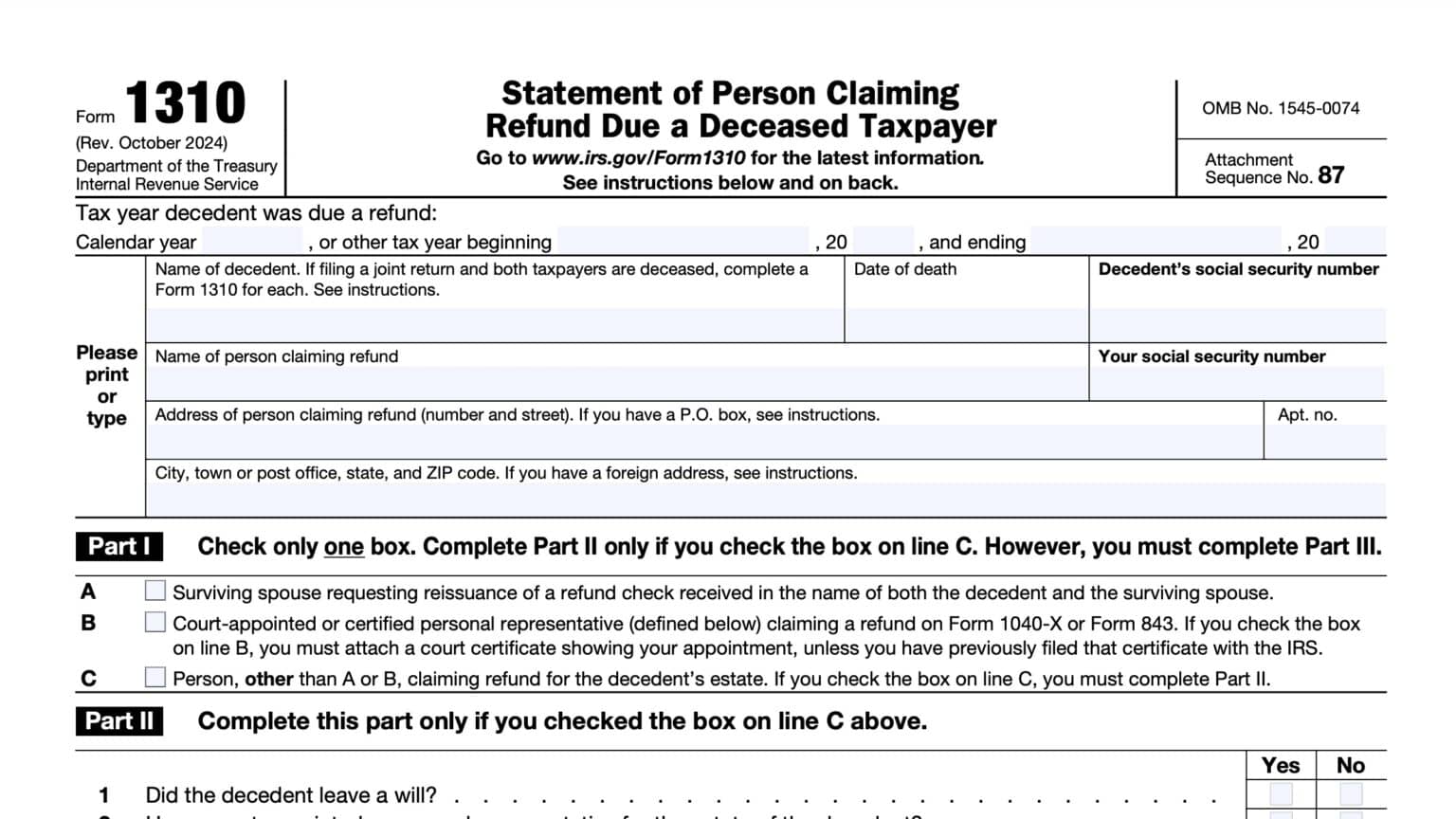

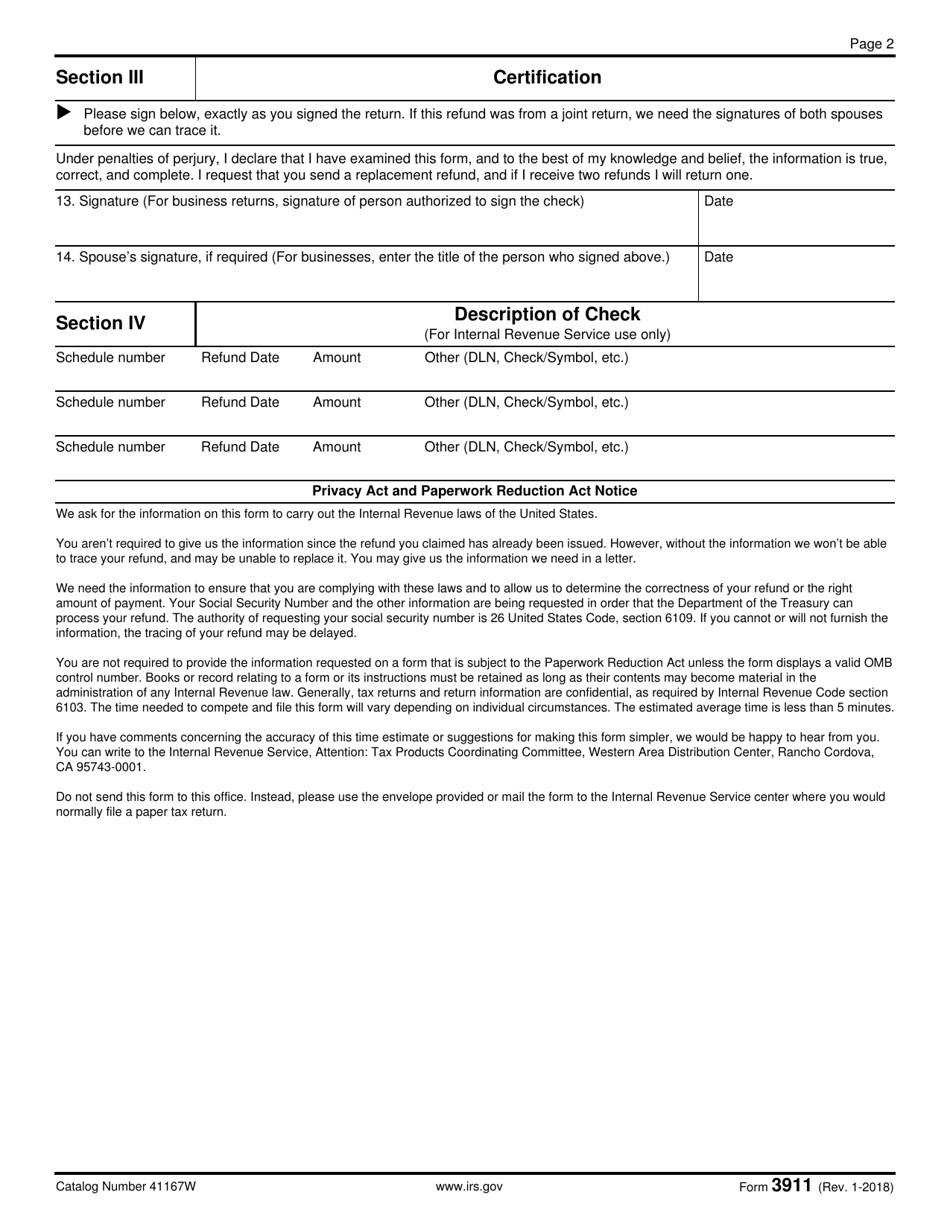

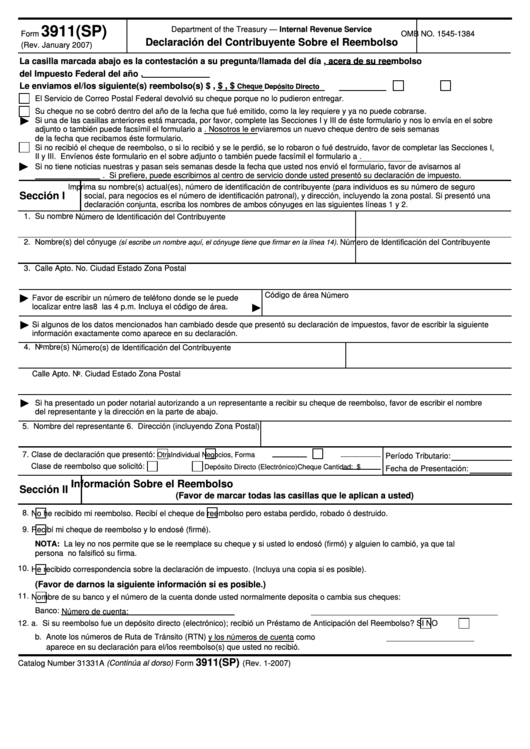

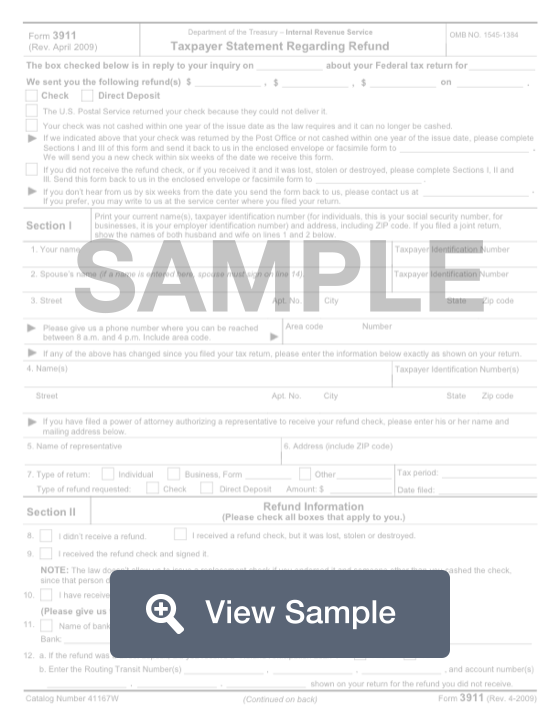

IRS Form 3911 Instructions Replacing A Lost Tax Refund Check

Do not send this form to this office. If your filing status is married filing jointly, you need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs. Once the appropriate time has passed, taxpayers can request a refund trace by submitting irs form 3911, taxpayer statement regarding. Instead, please use the envelope provided or mail.

IRS Form 3911 Download Fillable PDF or Fill Online Taxpayer Statement

Do not send this form to this office. Once the appropriate time has passed, taxpayers can request a refund trace by submitting irs form 3911, taxpayer statement regarding. If your filing status is married filing jointly, you need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs. Information about form 3911, taxpayer statement regarding refund,.

Free Irs Form 3911 Printable

Do not send this form to this office. Information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on. Once the appropriate time has passed, taxpayers can request a refund trace by submitting irs form 3911, taxpayer statement regarding. Instead, please use the envelope provided or mail the form to the internal revenue service center.

IRS Form 3911 Download Fillable PDF or Fill Online Taxpayer Statement

Do not send this form to this office. Information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on. Once the appropriate time has passed, taxpayers can request a refund trace by submitting irs form 3911, taxpayer statement regarding. Instead, please use the envelope provided or mail the form to the internal revenue service center.

Form 3911 Taxpayer Statement Regarding Refund (2012) Free Download

Information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on. Call and speak with a representative to get the process started or download and complete form 3911, taxpayer statement regarding refund. Do not send this form to this office. If your filing status is married filing jointly, you need to complete form 3911, taxpayer.

IRS Form 3911 walkthrough (Taxpayer Statement Regarding Refund) YouTube

If your filing status is married filing jointly, you need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs. Do not send this form to this office. Once the appropriate time has passed, taxpayers can request a refund trace by submitting irs form 3911, taxpayer statement regarding. Instead, please use the envelope provided or mail.

3911, Taxpayer Statement Regarding Refund PDF Doc Template pdfFiller

Do not send this form to this office. If your filing status is married filing jointly, you need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs. Call and speak with a representative to get the process started or download and complete form 3911, taxpayer statement regarding refund. Once the appropriate time has passed, taxpayers.

Form 3911 How to Recover Your Missing Tax Refund Fast

Information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on. Call and speak with a representative to get the process started or download and complete form 3911, taxpayer statement regarding refund. Instead, please use the envelope provided or mail the form to the internal revenue service center where you would. Do not send this.

Form 3911 Fill Out Online PDF & Word IRS Refund Inquiries FormSwift

Do not send this form to this office. Once the appropriate time has passed, taxpayers can request a refund trace by submitting irs form 3911, taxpayer statement regarding. Instead, please use the envelope provided or mail the form to the internal revenue service center where you would. If your filing status is married filing jointly, you need to complete form.

Irs Form 3911 Printable 2021

Information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on. Do not send this form to this office. If your filing status is married filing jointly, you need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs. Once the appropriate time has passed, taxpayers can request a refund trace.

Once The Appropriate Time Has Passed, Taxpayers Can Request A Refund Trace By Submitting Irs Form 3911, Taxpayer Statement Regarding.

Call and speak with a representative to get the process started or download and complete form 3911, taxpayer statement regarding refund. Information about form 3911, taxpayer statement regarding refund, including recent updates, related forms, and instructions on. If your filing status is married filing jointly, you need to complete form 3911, taxpayer statement regarding refund, and mail it to the irs. Do not send this form to this office.