Sample Form 940 - Learn what it is and how to fill out form 940 here. Irs form 940 is the annual tax return used by employers to comply with the federal unemployment tax act (futa). Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on. Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Employers must generally pay federal unemployment tax and report it on form 940. Run a payroll summary report for the form 940 filing period and note the amounts for the payroll items with the matching tax tracking types.

Irs form 940 is the annual tax return used by employers to comply with the federal unemployment tax act (futa). Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on. Run a payroll summary report for the form 940 filing period and note the amounts for the payroll items with the matching tax tracking types. Learn what it is and how to fill out form 940 here. Employers must generally pay federal unemployment tax and report it on form 940. Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types.

Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Learn what it is and how to fill out form 940 here. Run a payroll summary report for the form 940 filing period and note the amounts for the payroll items with the matching tax tracking types. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on. Employers must generally pay federal unemployment tax and report it on form 940. Irs form 940 is the annual tax return used by employers to comply with the federal unemployment tax act (futa).

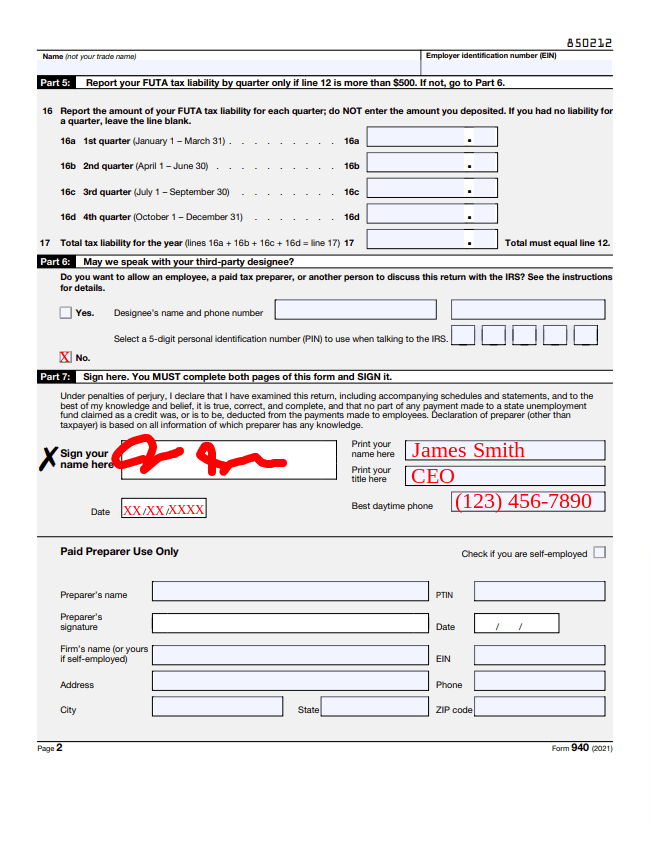

How to Fill Out Form 940 Instructions, Example, & More

Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on. Irs form 940 is the annual tax return used by employers to comply with the federal unemployment tax act (futa). Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Employers must generally pay.

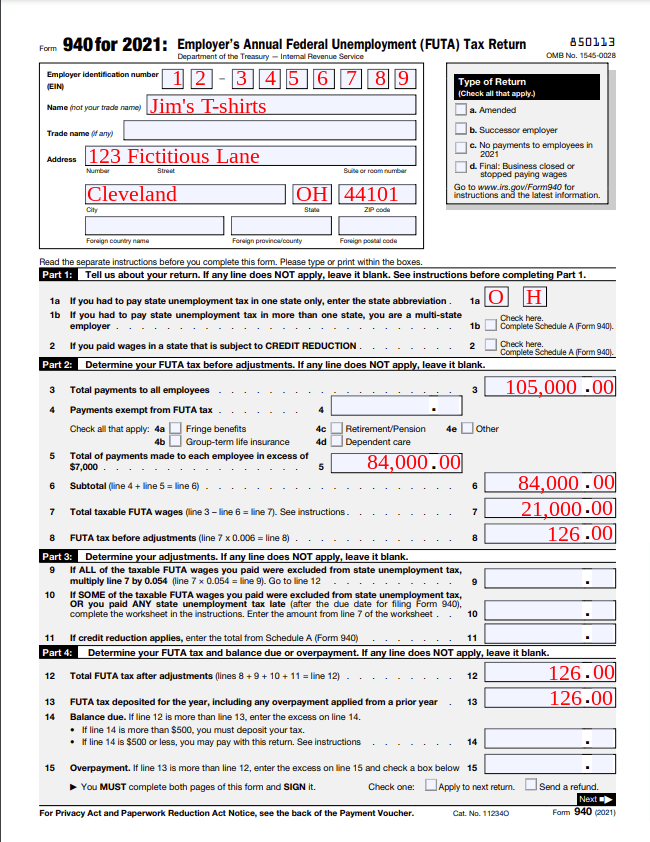

Example Of Form 940

Learn what it is and how to fill out form 940 here. Irs form 940 is the annual tax return used by employers to comply with the federal unemployment tax act (futa). Run a payroll summary report for the form 940 filing period and note the amounts for the payroll items with the matching tax tracking types. Employers must generally.

What Is IRS Form 940?

Employers must generally pay federal unemployment tax and report it on form 940. Run a payroll summary report for the form 940 filing period and note the amounts for the payroll items with the matching tax tracking types. Learn what it is and how to fill out form 940 here. Irs form 940 is the annual tax return used by.

What is IRS Form 940?

Run a payroll summary report for the form 940 filing period and note the amounts for the payroll items with the matching tax tracking types. Employers must generally pay federal unemployment tax and report it on form 940. Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Irs form 940 is the.

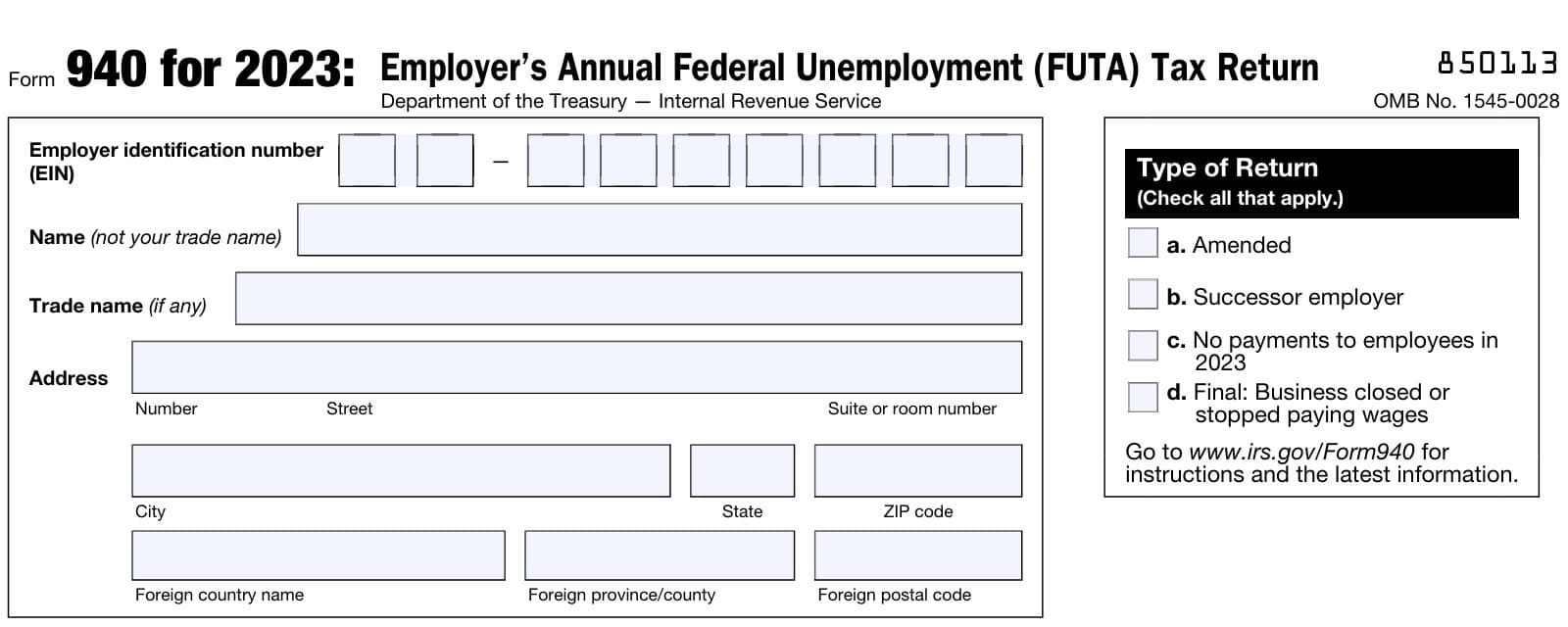

IRS Form 940 for 2023 > Printable 940 Tax Form or Fillable PDF With

Employers must generally pay federal unemployment tax and report it on form 940. Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Irs form 940 is the annual tax return used by employers to comply with the federal unemployment tax act (futa). Learn what it is and how to fill out form.

How to Fill Out Form 940 Instructions, Example, & More

Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on. Employers must generally pay federal unemployment tax and report it on form 940. Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Irs form 940 is the annual tax return used by employers.

Employer Taxes, Payments, and Reports ppt download

Employers must generally pay federal unemployment tax and report it on form 940. Learn what it is and how to fill out form 940 here. Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Run a payroll summary report for the form 940 filing period and note the amounts for the payroll.

IRS Form 940 Instructions Federal Unemployment Tax Return

Run a payroll summary report for the form 940 filing period and note the amounts for the payroll items with the matching tax tracking types. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on. Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business.

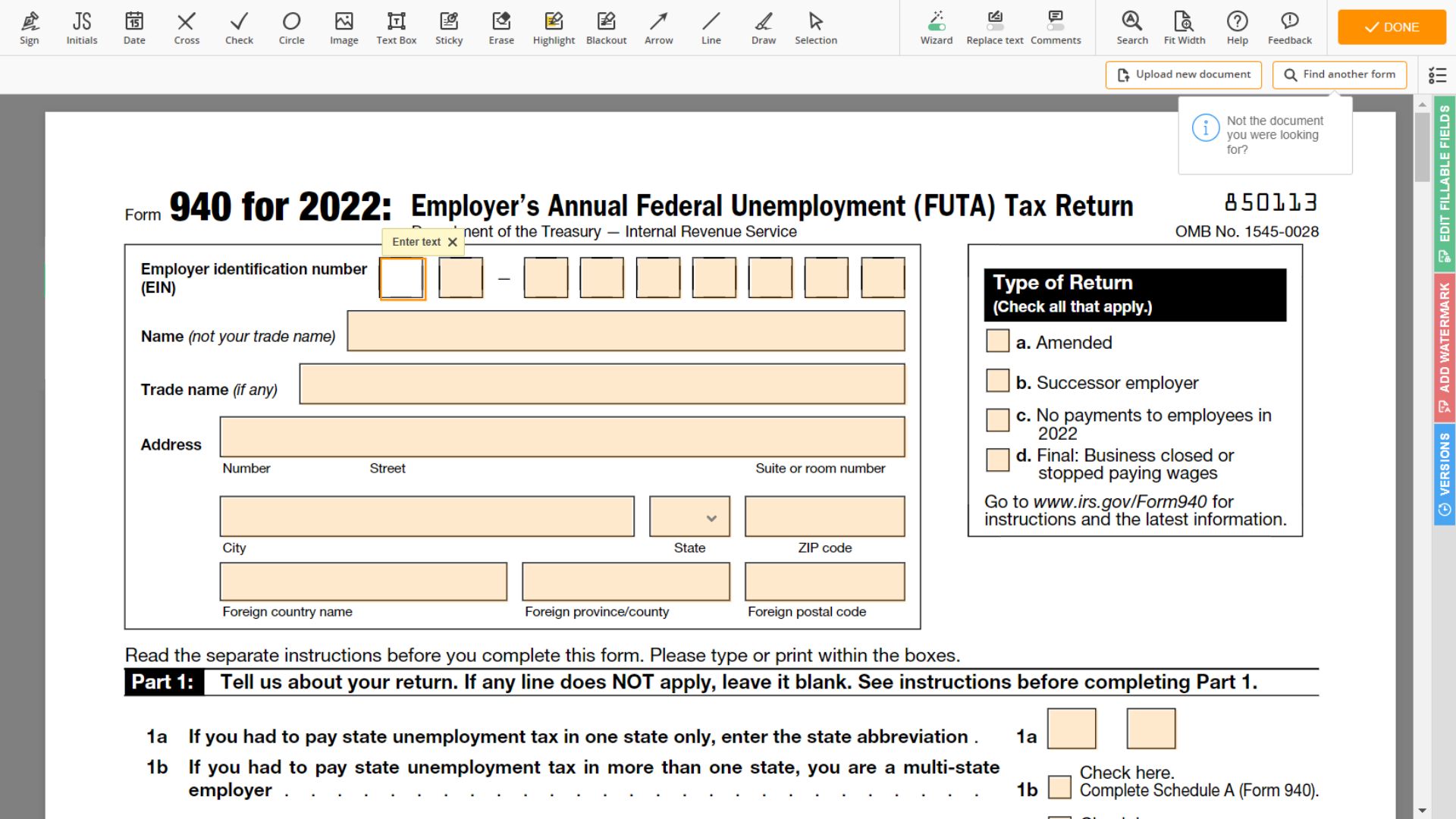

Form 940 Instructions StepbyStep Guide Fundera

Learn what it is and how to fill out form 940 here. Irs form 940 is the annual tax return used by employers to comply with the federal unemployment tax act (futa). Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Information about form 940, employer's annual federal unemployment (futa) tax return,.

IRS Form 940 Instructions Federal Unemployment Tax Return

Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Irs form 940 is the annual tax return used by employers to comply with the federal unemployment tax act (futa). Learn what it is and how to fill out form 940 here. Employers must generally pay federal unemployment tax and report it on.

Learn What It Is And How To Fill Out Form 940 Here.

Irs form 940 is the annual tax return used by employers to comply with the federal unemployment tax act (futa). Explore comprehensive examples of form 940, the employer's annual futa tax return, tailored for various business types. Information about form 940, employer's annual federal unemployment (futa) tax return, including recent updates, related forms and instructions on. Run a payroll summary report for the form 940 filing period and note the amounts for the payroll items with the matching tax tracking types.

:max_bytes(150000):strip_icc()/IRSForm940-2036a6d75e47453db1b2c5ffc3418919.jpg)

+--+Above+is+a+sample+Form+940..jpg)