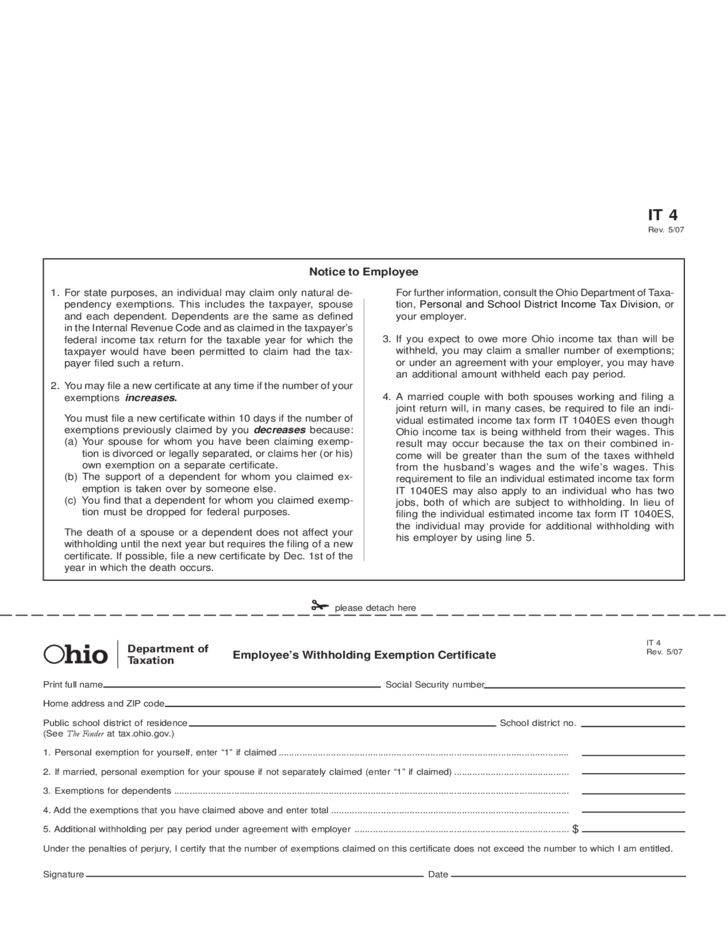

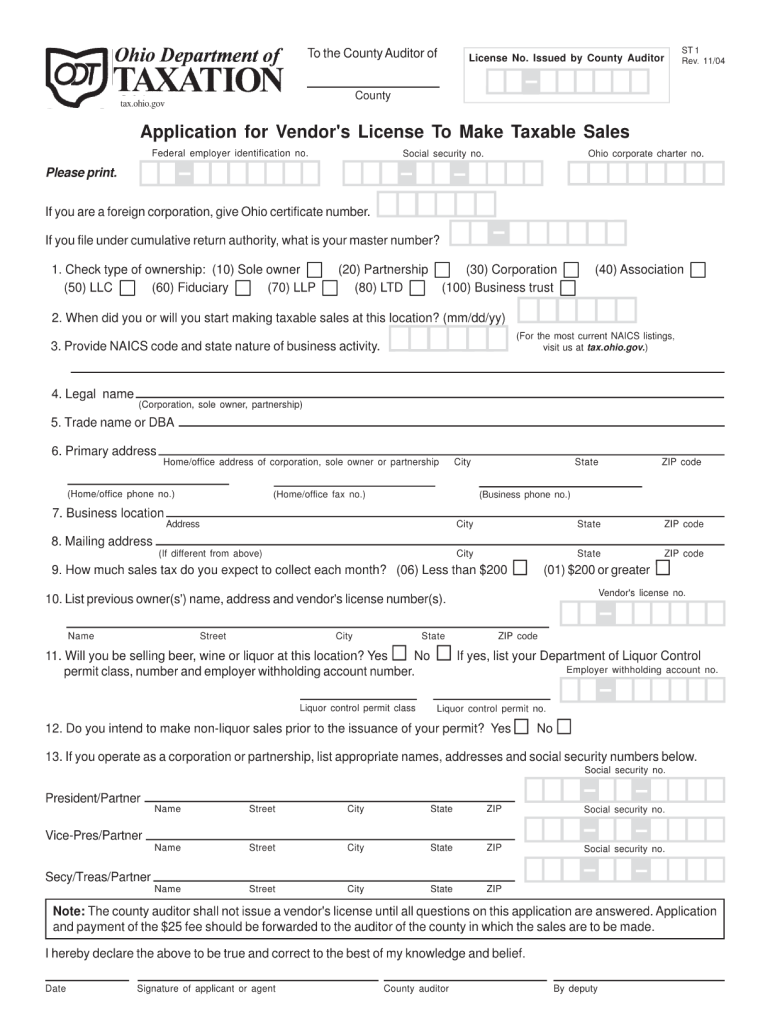

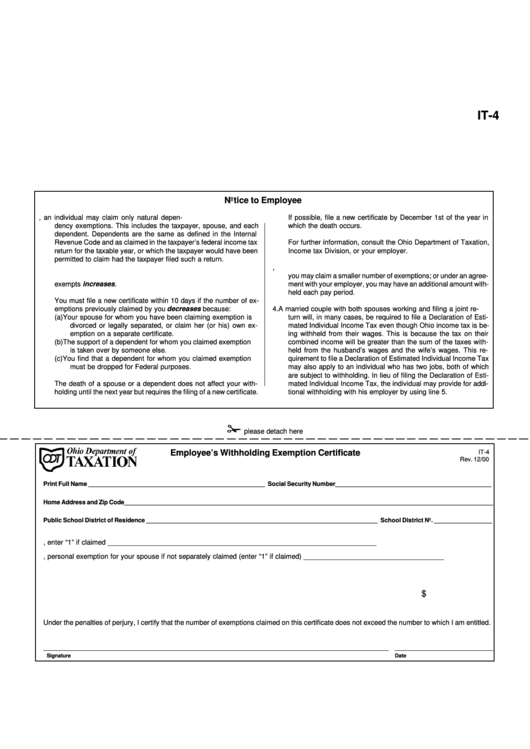

Ohio Withholding Form 2025 - The employee uses the ohio it 4 to determine the. Register online through the ohio. All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. Responsible party assessment — employees of government agencies concerned with delinquent tax collections of sales and use, employer. The employer is required to have each employee that works in ohio to complete this form. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your.

The employer is required to have each employee that works in ohio to complete this form. Register online through the ohio. Responsible party assessment — employees of government agencies concerned with delinquent tax collections of sales and use, employer. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The employee uses the ohio it 4 to determine the. All employers required to withhold ohio income taxes must register within 15 days of when such liability begins.

Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The employee uses the ohio it 4 to determine the. All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. Register online through the ohio. Responsible party assessment — employees of government agencies concerned with delinquent tax collections of sales and use, employer. The employer is required to have each employee that works in ohio to complete this form.

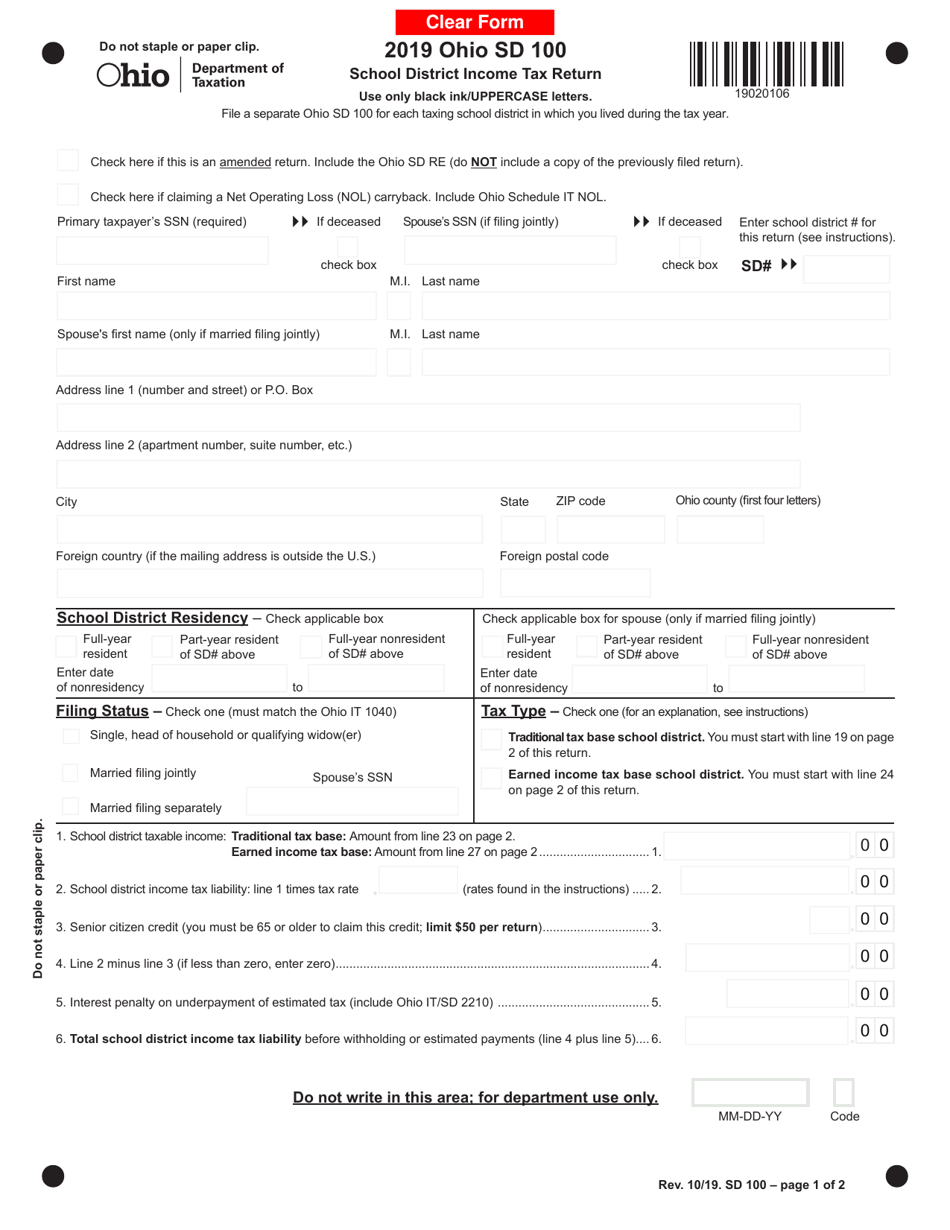

Do You Claim Exemption From Withholding For 2025 Angela J Christman

All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. The employee uses the ohio it 4 to determine the. Register online through the ohio. The employer is required to have each employee that works in ohio to complete this form. Responsible party assessment — employees of government agencies concerned with delinquent.

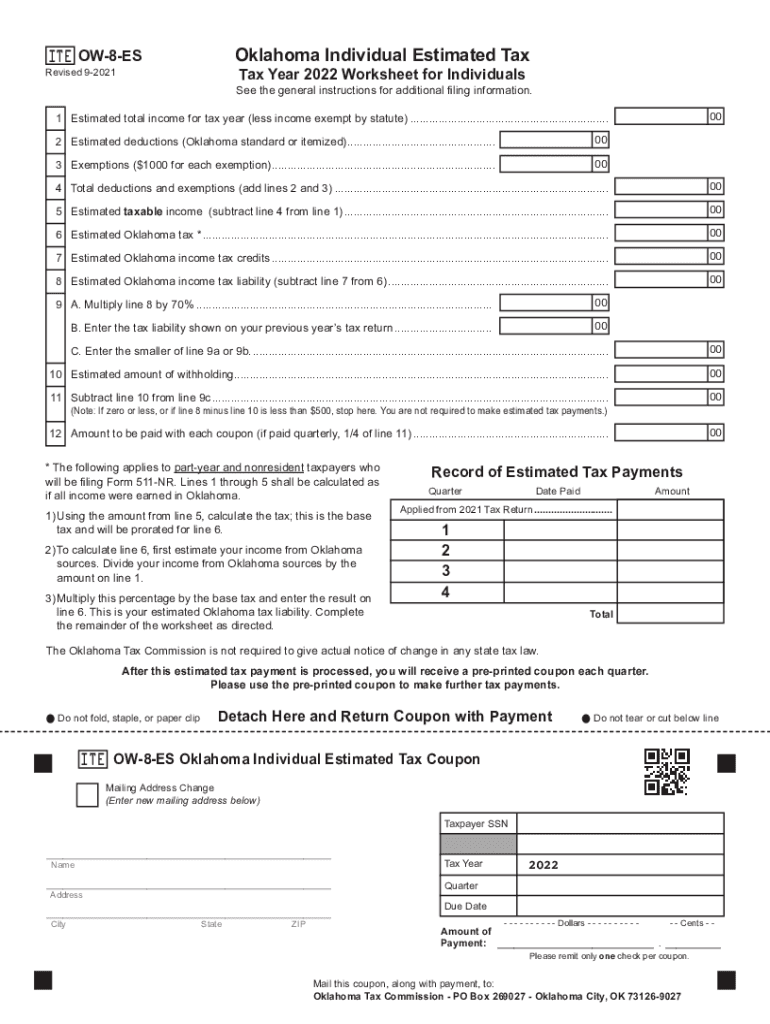

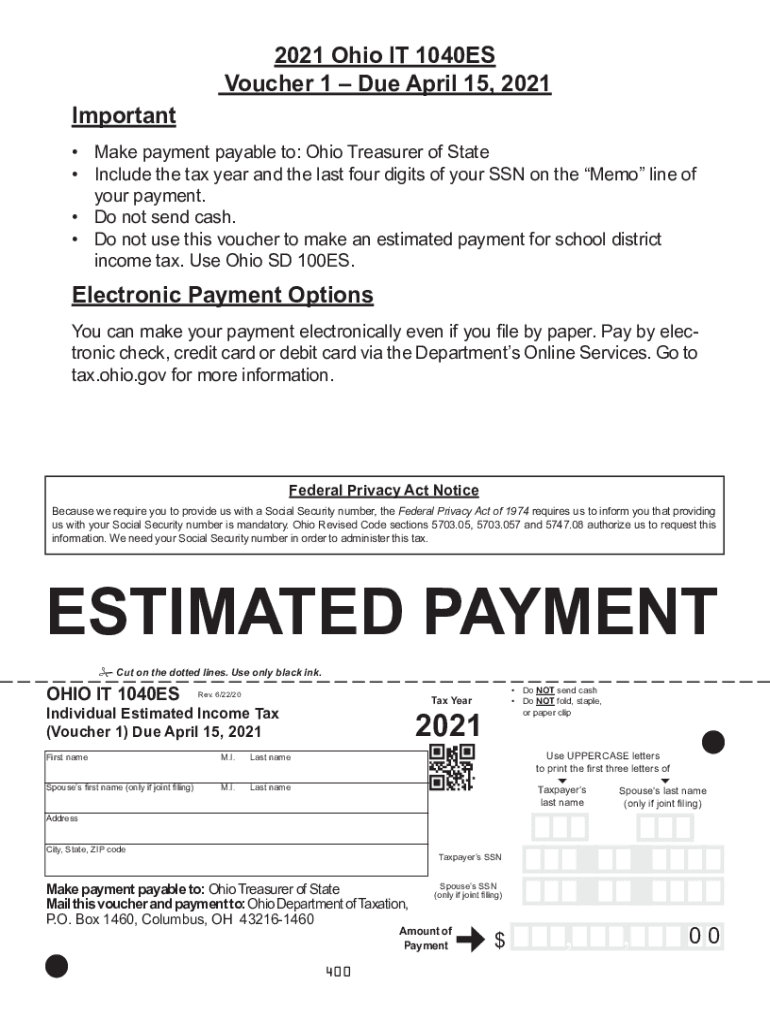

Ohio Estimated Tax Payments 2025 Forms Laura H. Wentcher

Responsible party assessment — employees of government agencies concerned with delinquent tax collections of sales and use, employer. Register online through the ohio. All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. The employer is required to have each employee that works in ohio to complete this form. The employee uses.

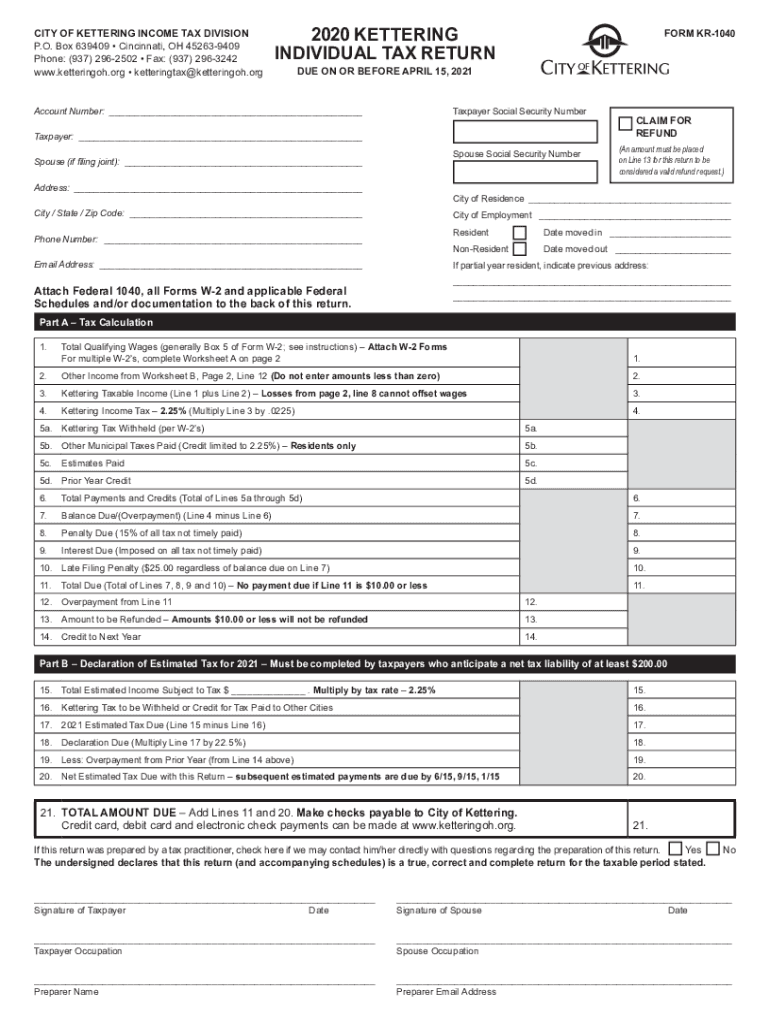

Kettering Ohio Tax S 20202025 Form Fill Out and Sign

All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. The employer is required to have each employee that works in ohio to complete this form. Responsible party assessment — employees of government agencies concerned with delinquent tax collections of sales and use, employer. Register online through the ohio. Submit form it.

Ohio Withholding Form 2025 Francesco P. Hoke

Responsible party assessment — employees of government agencies concerned with delinquent tax collections of sales and use, employer. The employer is required to have each employee that works in ohio to complete this form. The employee uses the ohio it 4 to determine the. All employers required to withhold ohio income taxes must register within 15 days of when such.

Ohio Withholding Form 2025 Julie Berenice

All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The employee uses the ohio it 4 to determine the. The employer is required to.

Ohio Withholding Form 2025 Julie Berenice

The employee uses the ohio it 4 to determine the. All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Responsible party assessment — employees.

Ohio Withholding Form 2025 Julie Berenice

The employee uses the ohio it 4 to determine the. Responsible party assessment — employees of government agencies concerned with delinquent tax collections of sales and use, employer. All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. The employer is required to have each employee that works in ohio to complete.

Ohio Withholding Form 2025 Julie Berenice

All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The employee uses the ohio it 4 to determine the. Register online through the ohio..

Ohio Tax Estimated Payment Form 2025 Marielle M. Hadley

Responsible party assessment — employees of government agencies concerned with delinquent tax collections of sales and use, employer. The employer is required to have each employee that works in ohio to complete this form. Register online through the ohio. The employee uses the ohio it 4 to determine the. All employers required to withhold ohio income taxes must register within.

Ohio W4 Form 2025 W4 Form 2025

All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. Register online through the ohio. The employee uses the ohio it 4 to determine the. The employer is required to have each employee that works in ohio to complete this form. Responsible party assessment — employees of government agencies concerned with delinquent.

Register Online Through The Ohio.

Responsible party assessment — employees of government agencies concerned with delinquent tax collections of sales and use, employer. All employers required to withhold ohio income taxes must register within 15 days of when such liability begins. The employer is required to have each employee that works in ohio to complete this form. The employee uses the ohio it 4 to determine the.