Ip Form - This form is only for new requests to opt into the ip pin program. The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l. This form is provided for your convenience; To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. If you’ve lost your ip pin, or. Do not file form 15227 if you have already been assigned an ip pin. Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin.

The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. This form is only for new requests to opt into the ip pin program. This form is provided for your convenience; Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin. Do not file form 15227 if you have already been assigned an ip pin. If you’ve lost your ip pin, or.

This form is only for new requests to opt into the ip pin program. The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l. Do not file form 15227 if you have already been assigned an ip pin. If you’ve lost your ip pin, or. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. This form is provided for your convenience; Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin.

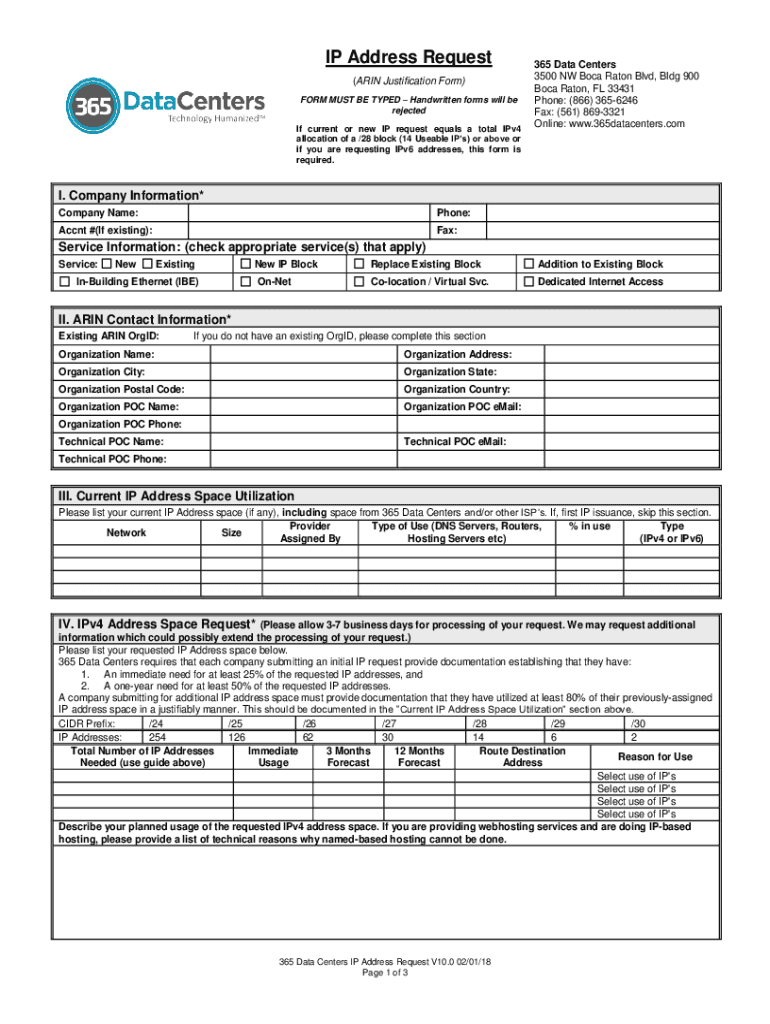

Fillable Online Fillable Online ip address request and justification

This form is only for new requests to opt into the ip pin program. Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as.

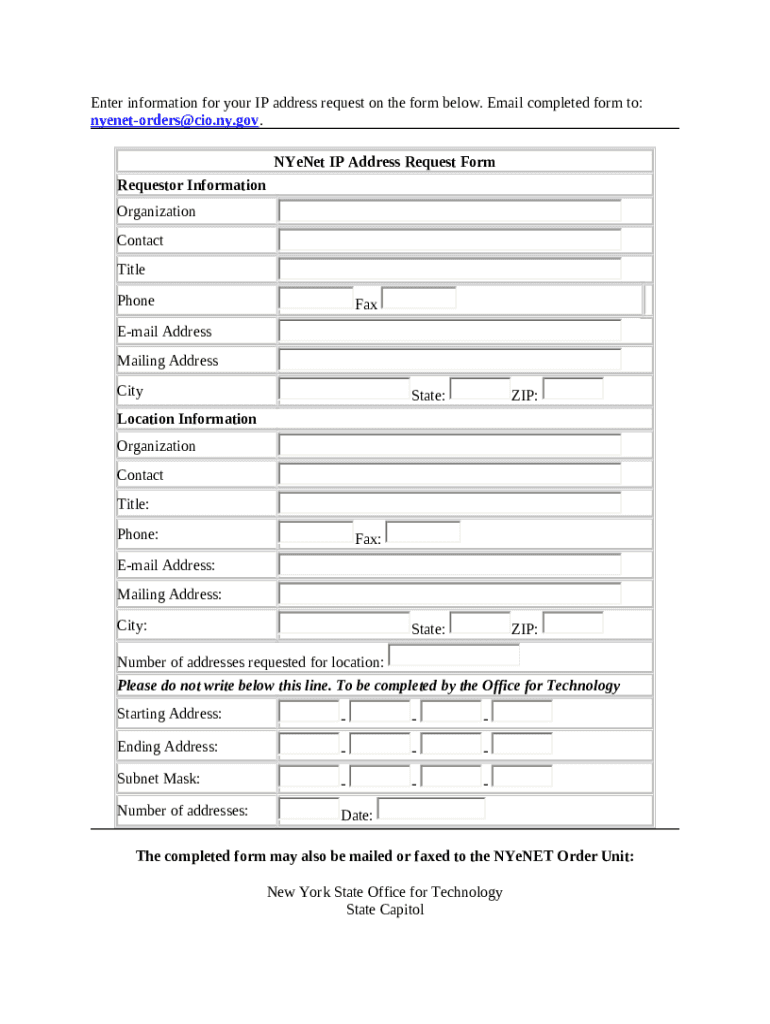

Enter ination for your IP address request on the below Doc Template

To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. This form is provided for your convenience; Do not file form 15227 if you have already been assigned an ip pin. This form is only for new requests to opt into the ip pin program. If.

What Is An IP Address SEN.news No. 1

Do not file form 15227 if you have already been assigned an ip pin. If you’ve lost your ip pin, or. The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the..

Chapter 5 Network Layer (Part III) ppt download

To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. If you’ve lost your ip pin, or. Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin. Do not file form 15227 if.

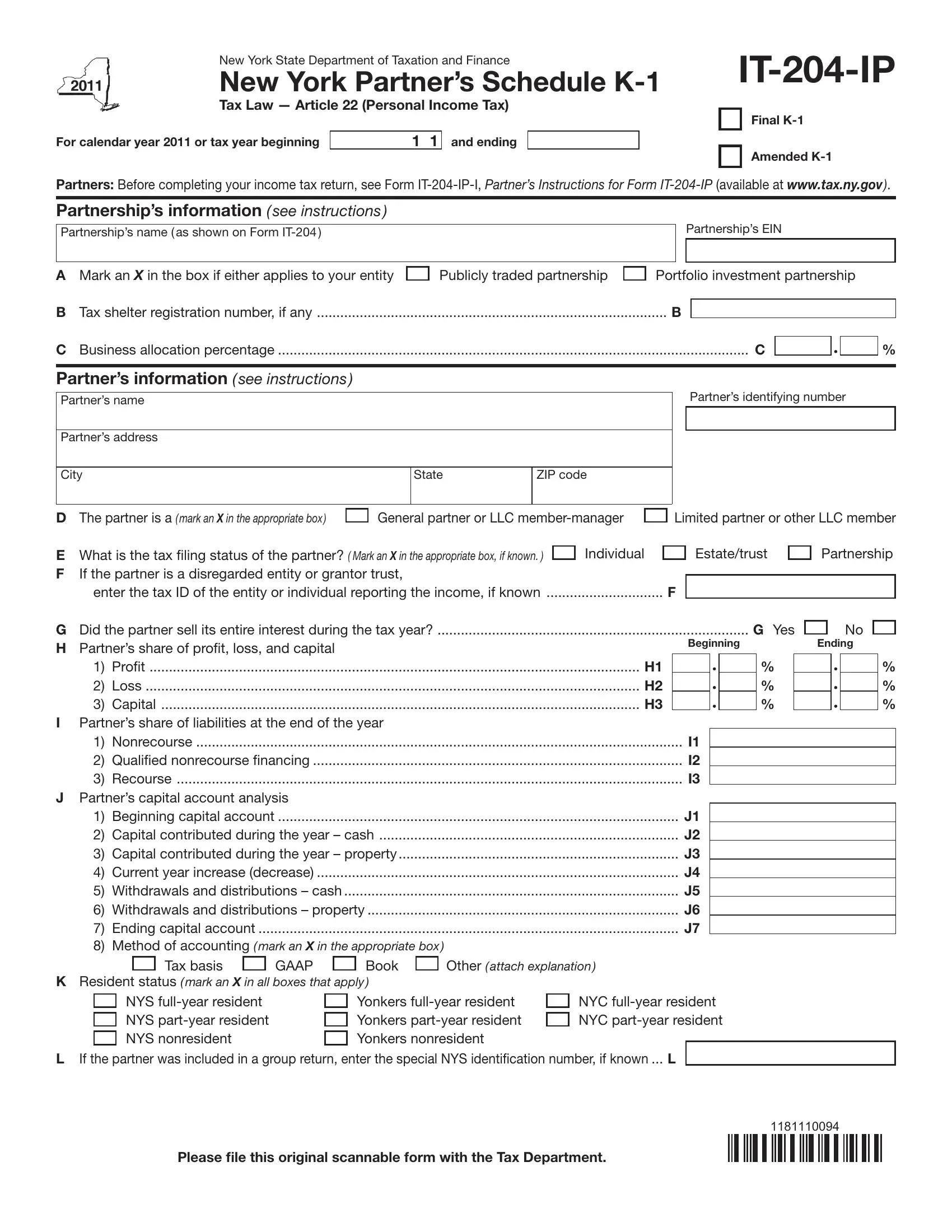

Form IT204IP ≡ Fill Out Printable PDF Forms Online

To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. This form is provided for your convenience; Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin. This form is only for new.

(PDF) STATIC INTERNAL/PUBLIC IP ADDRESS REQUEST …oit.tsu.edu/wpcontent

Do not file form 15227 if you have already been assigned an ip pin. The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l. Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin. To lower the chances of a fraudulent return,.

IP Justification Form Ip Address Domain Name System

If you’ve lost your ip pin, or. The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l. This form is provided for your convenience; Do not file form 15227 if you have already been assigned an ip pin. Do not submit this form if you already have an ip pin or received notification from irs.

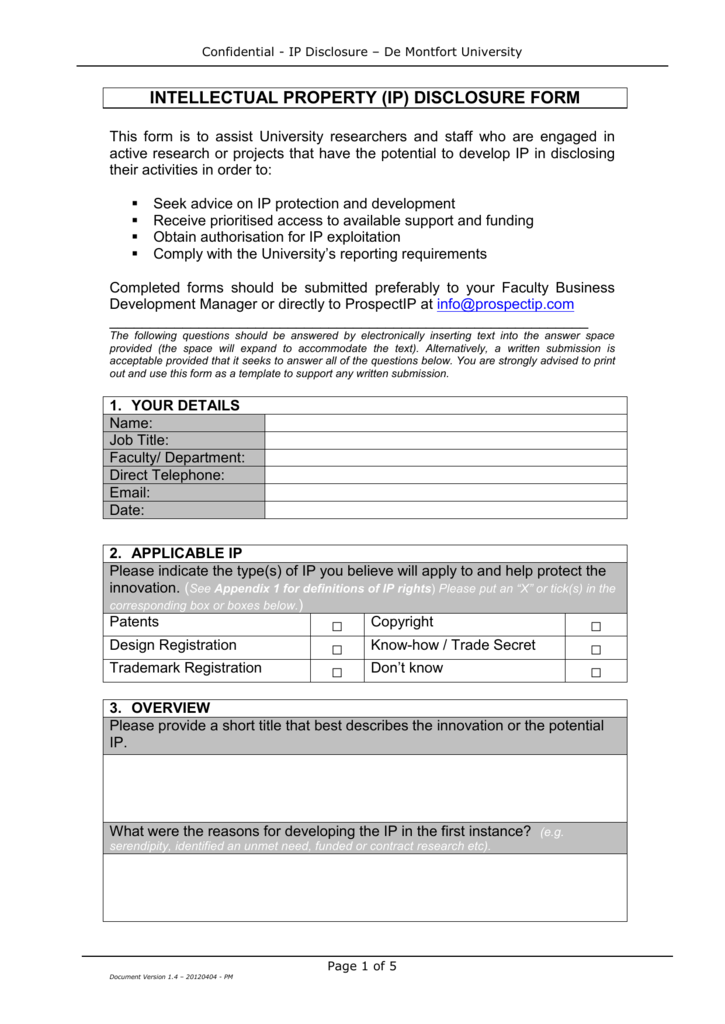

Intellectual Property Disclosure Form

If you’ve lost your ip pin, or. The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l. This form is only for new requests to opt into the ip pin program. Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin. To.

How to Submit IP Requests UCSF IT

The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l. If you’ve lost your ip pin, or. To lower the chances of a fraudulent return, victims of identity theft can participate in the irs identity protection pin program, known as the. This form is provided for your convenience; Do not file form 15227 if you.

Fillable Online Request a Static IP Address Fax Email Print

This form is provided for your convenience; Do not file form 15227 if you have already been assigned an ip pin. The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l. Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin. If.

Do Not File Form 15227 If You Have Already Been Assigned An Ip Pin.

If you’ve lost your ip pin, or. This form is provided for your convenience; This form is only for new requests to opt into the ip pin program. The internal revenue code (i.r.c.) § 7803 and the taxpayer first act of 2019 (p.l.

To Lower The Chances Of A Fraudulent Return, Victims Of Identity Theft Can Participate In The Irs Identity Protection Pin Program, Known As The.

Do not submit this form if you already have an ip pin or received notification from irs you’ve been assigned an ip pin.