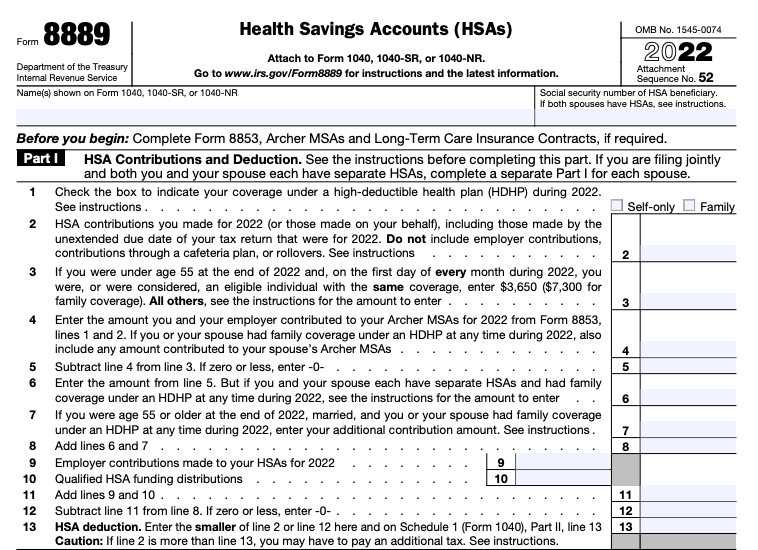

Form 8889 Part 1 - The contribution to fund the hsa comes from my employer off my payroll. Her excess contributions for october, november, december 2023 due to. Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. The hdhp was in effect before january 2022 and continued. Where on form 8889 does employer contribution to hsa go?

Where on form 8889 does employer contribution to hsa go? Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. The hdhp was in effect before january 2022 and continued. The contribution to fund the hsa comes from my employer off my payroll. Her excess contributions for october, november, december 2023 due to.

The contribution to fund the hsa comes from my employer off my payroll. Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. Her excess contributions for october, november, december 2023 due to. The hdhp was in effect before january 2022 and continued. Where on form 8889 does employer contribution to hsa go?

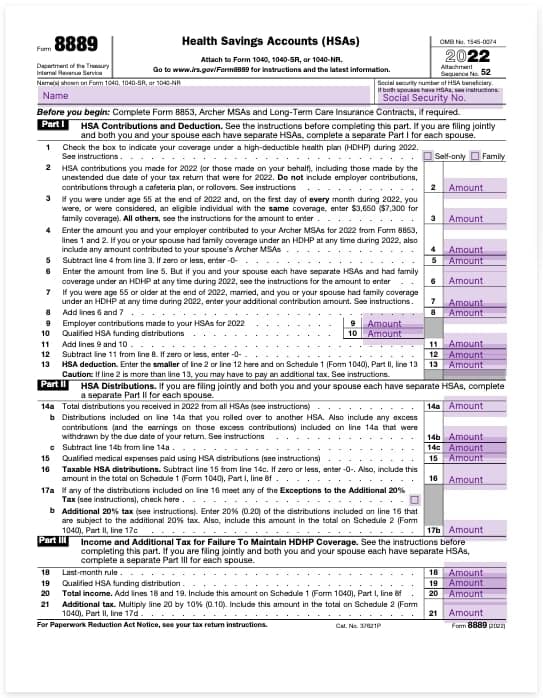

Irs Form 8889 For 2025 John Patrick

Where on form 8889 does employer contribution to hsa go? Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. The hdhp was in effect before january 2022 and continued. The contribution to fund the hsa comes from my employer off my payroll. Her excess contributions for october, november, december 2023 due to.

Irs Form 8889 For 2025 John Patrick

Where on form 8889 does employer contribution to hsa go? The contribution to fund the hsa comes from my employer off my payroll. Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. The hdhp was in effect before january 2022 and continued. Her excess contributions for october, november, december 2023 due to.

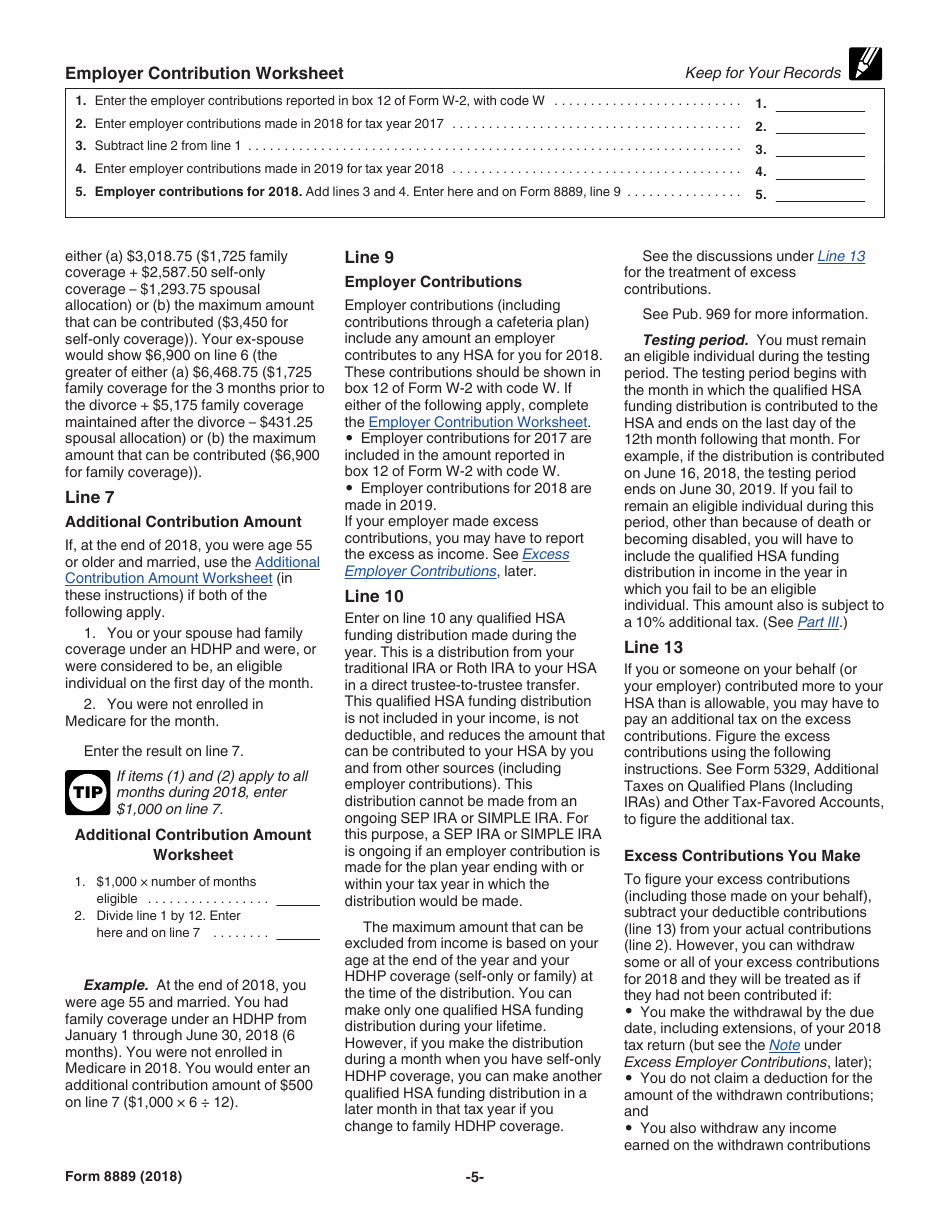

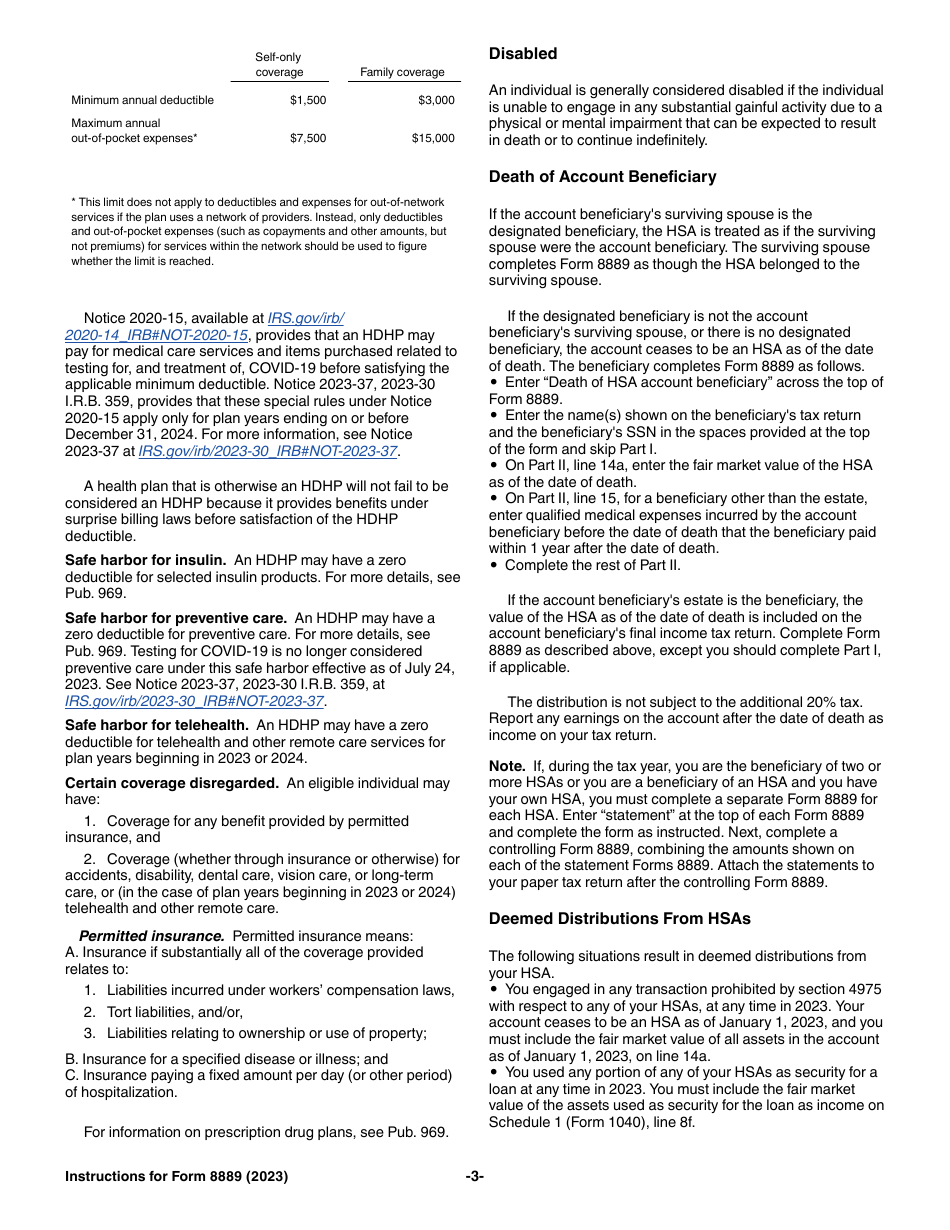

Download Instructions for IRS Form 8889 Health Savings Accounts (Hsas

Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. The hdhp was in effect before january 2022 and continued. The contribution to fund the hsa comes from my employer off my payroll. Where on form 8889 does employer contribution to hsa go? Her excess contributions for october, november, december 2023 due to.

How to file HSA Form 8889 YouTube

The contribution to fund the hsa comes from my employer off my payroll. Her excess contributions for october, november, december 2023 due to. Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. Where on form 8889 does employer contribution to hsa go? The hdhp was in effect before january 2022 and continued.

TurboTax 2022 Form 1040 How to Record HSA Contributions Form 8889

Where on form 8889 does employer contribution to hsa go? Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. The hdhp was in effect before january 2022 and continued. The contribution to fund the hsa comes from my employer off my payroll. Her excess contributions for october, november, december 2023 due to.

Understanding Form 8889 For HSA Contributions

Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. The contribution to fund the hsa comes from my employer off my payroll. The hdhp was in effect before january 2022 and continued. Her excess contributions for october, november, december 2023 due to. Where on form 8889 does employer contribution to hsa go?

Understanding Form 8889 For HSA Contributions

The hdhp was in effect before january 2022 and continued. Her excess contributions for october, november, december 2023 due to. The contribution to fund the hsa comes from my employer off my payroll. Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. Where on form 8889 does employer contribution to hsa go?

Irs Zero And Refund Form 8889 Filing Required

Her excess contributions for october, november, december 2023 due to. Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. The hdhp was in effect before january 2022 and continued. Where on form 8889 does employer contribution to hsa go? The contribution to fund the hsa comes from my employer off my payroll.

Get a Copy of Form 8889 Health Savings Accounts (HSAs)

The contribution to fund the hsa comes from my employer off my payroll. Where on form 8889 does employer contribution to hsa go? Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. The hdhp was in effect before january 2022 and continued. Her excess contributions for october, november, december 2023 due to.

Download Instructions for IRS Form 8889 Health Savings Accounts (Hsas

The hdhp was in effect before january 2022 and continued. Her excess contributions for october, november, december 2023 due to. Where on form 8889 does employer contribution to hsa go? The contribution to fund the hsa comes from my employer off my payroll. Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000.

The Hdhp Was In Effect Before January 2022 And Continued.

Line 3 on our 2023 form 8889 is $7,750 and line 11 is $4,000. Where on form 8889 does employer contribution to hsa go? Her excess contributions for october, november, december 2023 due to. The contribution to fund the hsa comes from my employer off my payroll.