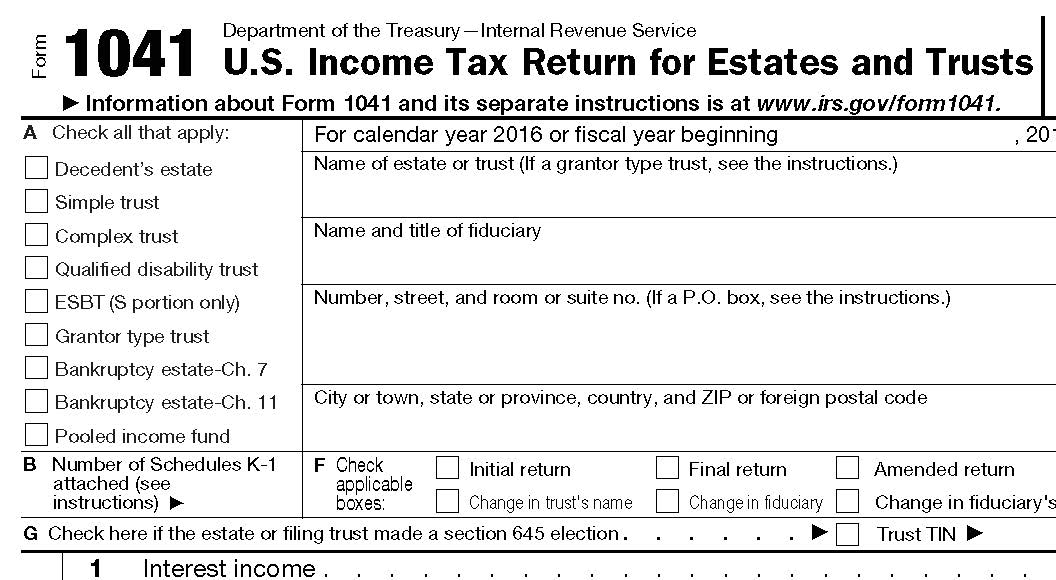

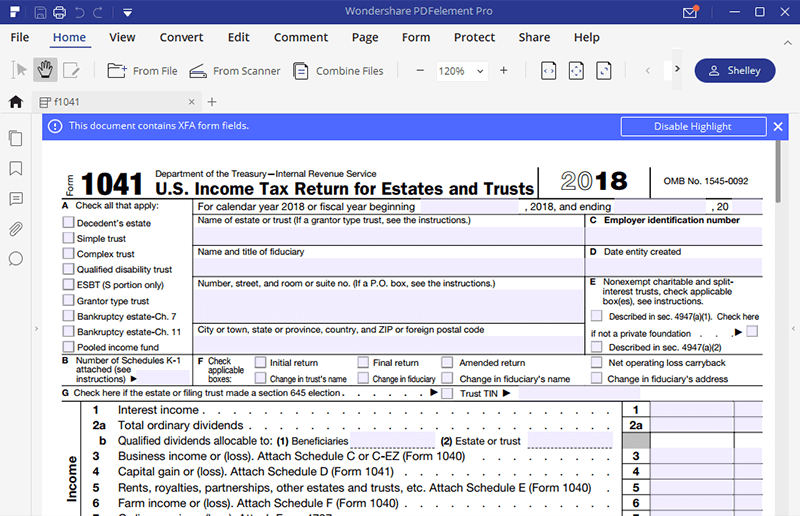

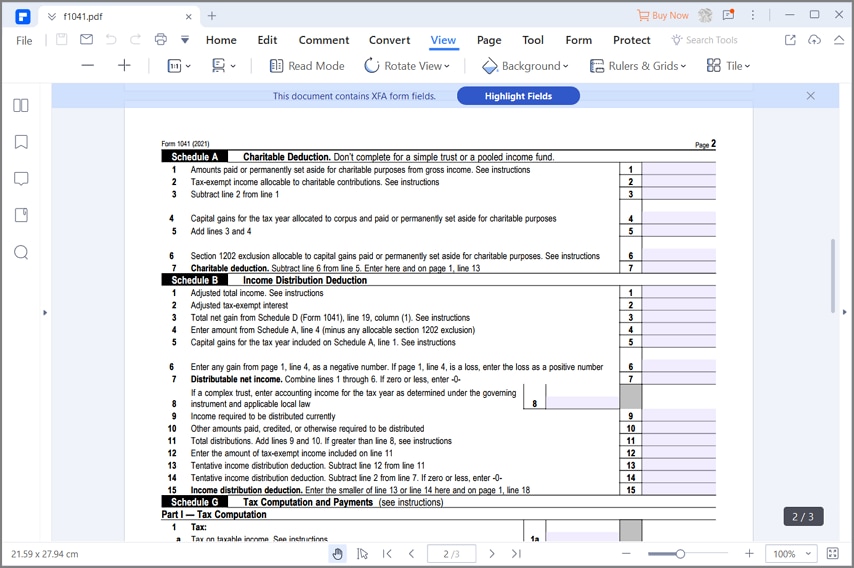

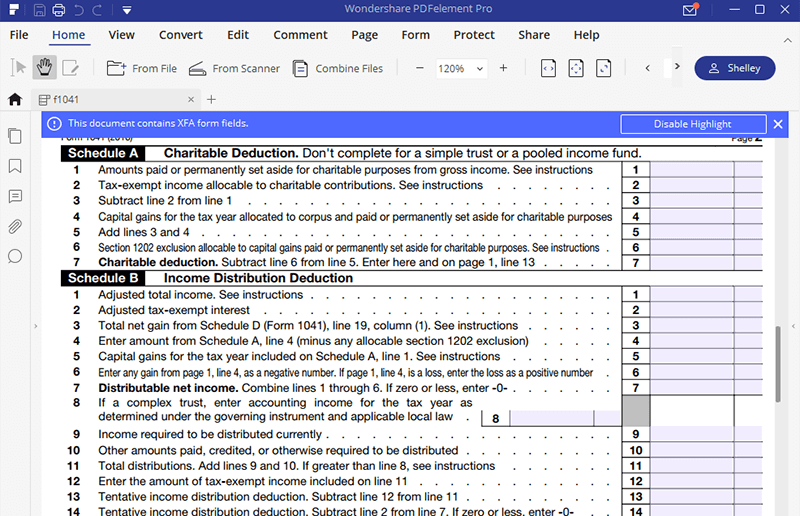

Form 1041 Schedule B - Schedule b looks simple and makes sense though. Schedule i of form 1041 is for reporting alternative minimum tax. Form 1041 is an estate *income* tax return. Distributions of corpus are only included on the schedule b line 10 to ensure that amounts. It looks like if the trust had no income after filling out schedule b line 15 would be 0 and. Schedule b is on the second page of the trust tax return form 1041: Trust accounting income form 1041 schedule b, line 8 i cant figure out how this is computed by turbo tax business. The accountant entered on the 1041, schedule b line 10 the net amount total that the beneficaries split 4 ways;

It looks like if the trust had no income after filling out schedule b line 15 would be 0 and. Schedule b is on the second page of the trust tax return form 1041: Schedule b looks simple and makes sense though. Schedule i of form 1041 is for reporting alternative minimum tax. Distributions of corpus are only included on the schedule b line 10 to ensure that amounts. Form 1041 is an estate *income* tax return. Trust accounting income form 1041 schedule b, line 8 i cant figure out how this is computed by turbo tax business. The accountant entered on the 1041, schedule b line 10 the net amount total that the beneficaries split 4 ways;

Trust accounting income form 1041 schedule b, line 8 i cant figure out how this is computed by turbo tax business. Form 1041 is an estate *income* tax return. Distributions of corpus are only included on the schedule b line 10 to ensure that amounts. The accountant entered on the 1041, schedule b line 10 the net amount total that the beneficaries split 4 ways; It looks like if the trust had no income after filling out schedule b line 15 would be 0 and. Schedule b looks simple and makes sense though. Schedule i of form 1041 is for reporting alternative minimum tax. Schedule b is on the second page of the trust tax return form 1041:

Irs Form 1040 Schedule B Fillable Printable Forms Free Online

Schedule b is on the second page of the trust tax return form 1041: Form 1041 is an estate *income* tax return. Schedule b looks simple and makes sense though. Trust accounting income form 1041 schedule b, line 8 i cant figure out how this is computed by turbo tax business. It looks like if the trust had no income.

Download Instructions for IRS Form 1041 Schedule A, B, G, J, K1 U.S

It looks like if the trust had no income after filling out schedule b line 15 would be 0 and. Trust accounting income form 1041 schedule b, line 8 i cant figure out how this is computed by turbo tax business. Form 1041 is an estate *income* tax return. The accountant entered on the 1041, schedule b line 10 the.

Schedule B 2024 Irs 49ers 2024 Schedule

Form 1041 is an estate *income* tax return. It looks like if the trust had no income after filling out schedule b line 15 would be 0 and. Distributions of corpus are only included on the schedule b line 10 to ensure that amounts. The accountant entered on the 1041, schedule b line 10 the net amount total that the.

Guide For How To Fill In IRS Form 1041, 58 OFF

Schedule b looks simple and makes sense though. Schedule i of form 1041 is for reporting alternative minimum tax. The accountant entered on the 1041, schedule b line 10 the net amount total that the beneficaries split 4 ways; It looks like if the trust had no income after filling out schedule b line 15 would be 0 and. Form.

Form 1041 V Fillable Printable Forms Free Online

Schedule i of form 1041 is for reporting alternative minimum tax. The accountant entered on the 1041, schedule b line 10 the net amount total that the beneficaries split 4 ways; Schedule b looks simple and makes sense though. Schedule b is on the second page of the trust tax return form 1041: Form 1041 is an estate *income* tax.

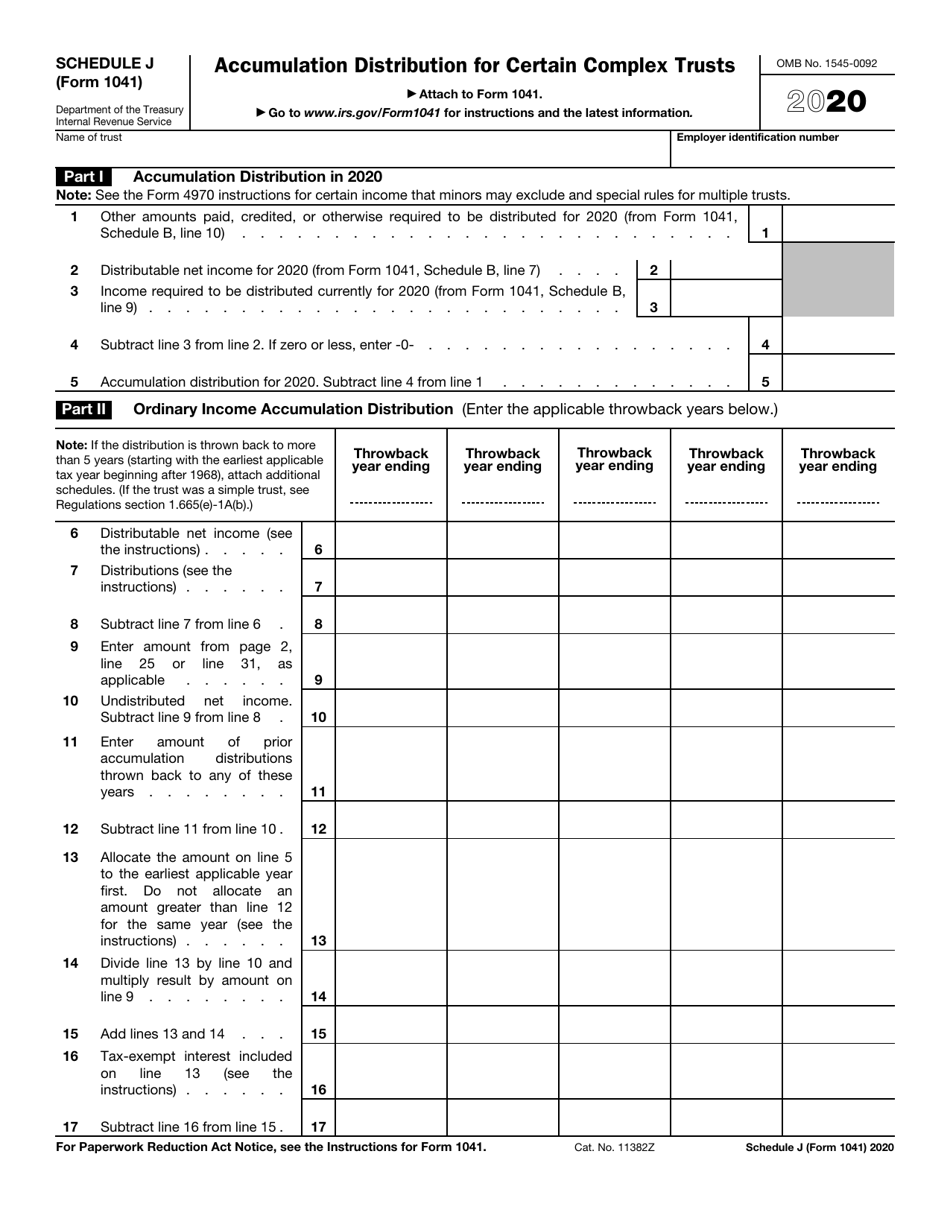

Guide for How to Fill in IRS Form 1041

Schedule i of form 1041 is for reporting alternative minimum tax. The accountant entered on the 1041, schedule b line 10 the net amount total that the beneficaries split 4 ways; Trust accounting income form 1041 schedule b, line 8 i cant figure out how this is computed by turbo tax business. Schedule b is on the second page of.

Guide for How to Fill in IRS Form 1041

Schedule i of form 1041 is for reporting alternative minimum tax. Form 1041 is an estate *income* tax return. The accountant entered on the 1041, schedule b line 10 the net amount total that the beneficaries split 4 ways; Distributions of corpus are only included on the schedule b line 10 to ensure that amounts. Schedule b looks simple and.

Irs Form Schedule B Printable Printable Forms Free Online

Schedule i of form 1041 is for reporting alternative minimum tax. The accountant entered on the 1041, schedule b line 10 the net amount total that the beneficaries split 4 ways; It looks like if the trust had no income after filling out schedule b line 15 would be 0 and. Distributions of corpus are only included on the schedule.

Form 1041 Schedule G 2025 Keira Mortlock T.

Schedule b is on the second page of the trust tax return form 1041: Distributions of corpus are only included on the schedule b line 10 to ensure that amounts. Form 1041 is an estate *income* tax return. Schedule i of form 1041 is for reporting alternative minimum tax. The accountant entered on the 1041, schedule b line 10 the.

Guide For How To Fill In IRS Form 1041, 58 OFF

Schedule b looks simple and makes sense though. Trust accounting income form 1041 schedule b, line 8 i cant figure out how this is computed by turbo tax business. Distributions of corpus are only included on the schedule b line 10 to ensure that amounts. It looks like if the trust had no income after filling out schedule b line.

Schedule I Of Form 1041 Is For Reporting Alternative Minimum Tax.

Schedule b is on the second page of the trust tax return form 1041: It looks like if the trust had no income after filling out schedule b line 15 would be 0 and. Form 1041 is an estate *income* tax return. Distributions of corpus are only included on the schedule b line 10 to ensure that amounts.

The Accountant Entered On The 1041, Schedule B Line 10 The Net Amount Total That The Beneficaries Split 4 Ways;

Trust accounting income form 1041 schedule b, line 8 i cant figure out how this is computed by turbo tax business. Schedule b looks simple and makes sense though.

:max_bytes(150000):strip_icc()/ScheduleB-InterestandOrdinaryDividends-c6ff80bf2c1f4de981e0b0625a4e3dc7.png)