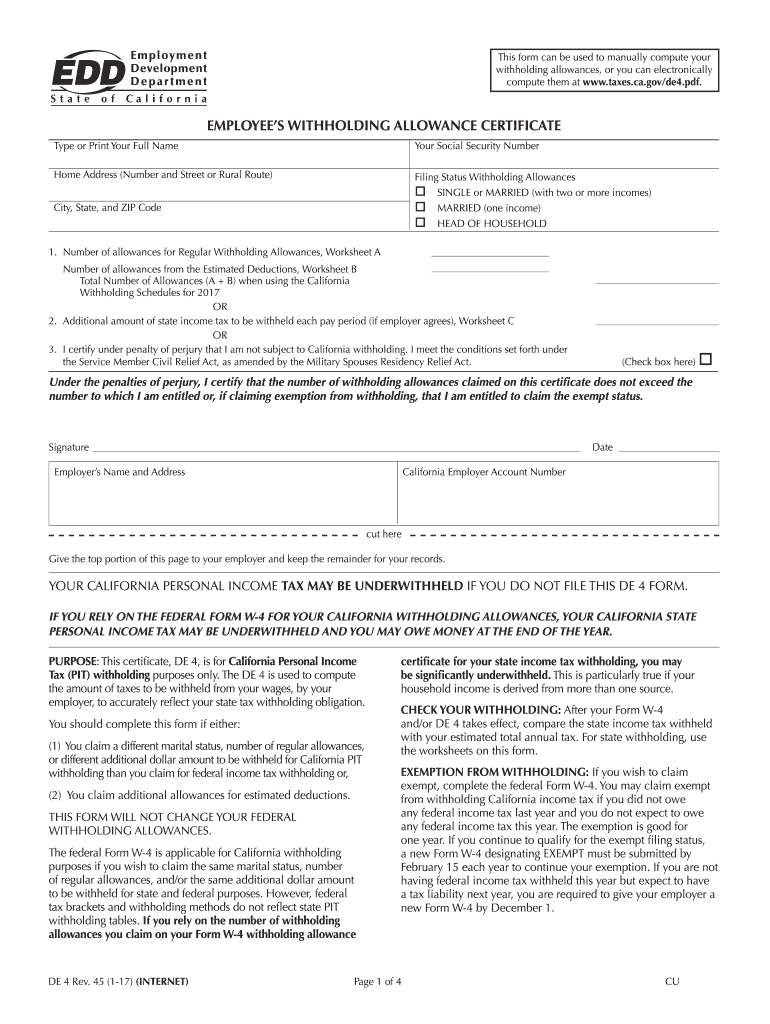

D 4 Form - Keep the bottom portion for your records. The de 4 is used to compute the amount of taxes to be withheld from your wages,. The information you supply must be. You simply enter your personal details, claim the correct number of withholding. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: California personal income tax (pit) withholding purposes only.

The information you supply must be. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: Keep the bottom portion for your records. California personal income tax (pit) withholding purposes only. You simply enter your personal details, claim the correct number of withholding. The de 4 is used to compute the amount of taxes to be withheld from your wages,.

The de 4 is used to compute the amount of taxes to be withheld from your wages,. The information you supply must be. Keep the bottom portion for your records. You simply enter your personal details, claim the correct number of withholding. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: California personal income tax (pit) withholding purposes only.

PPT You Should Know The Requirements for PCV Licence PowerPoint

The information you supply must be. Keep the bottom portion for your records. California personal income tax (pit) withholding purposes only. You simply enter your personal details, claim the correct number of withholding. Box 2396 annapolis, md 21404 federal employer identification number (ein) important:

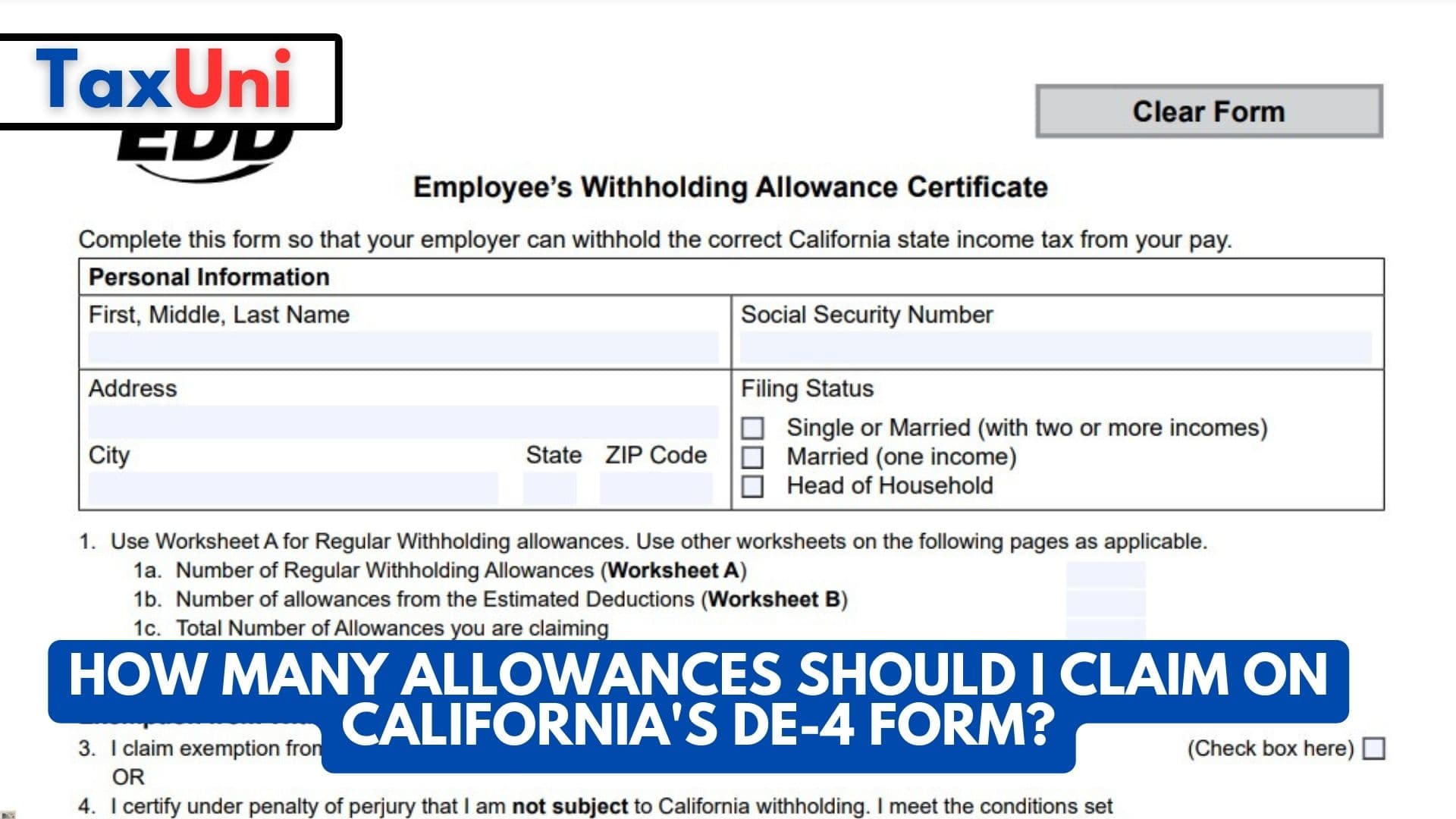

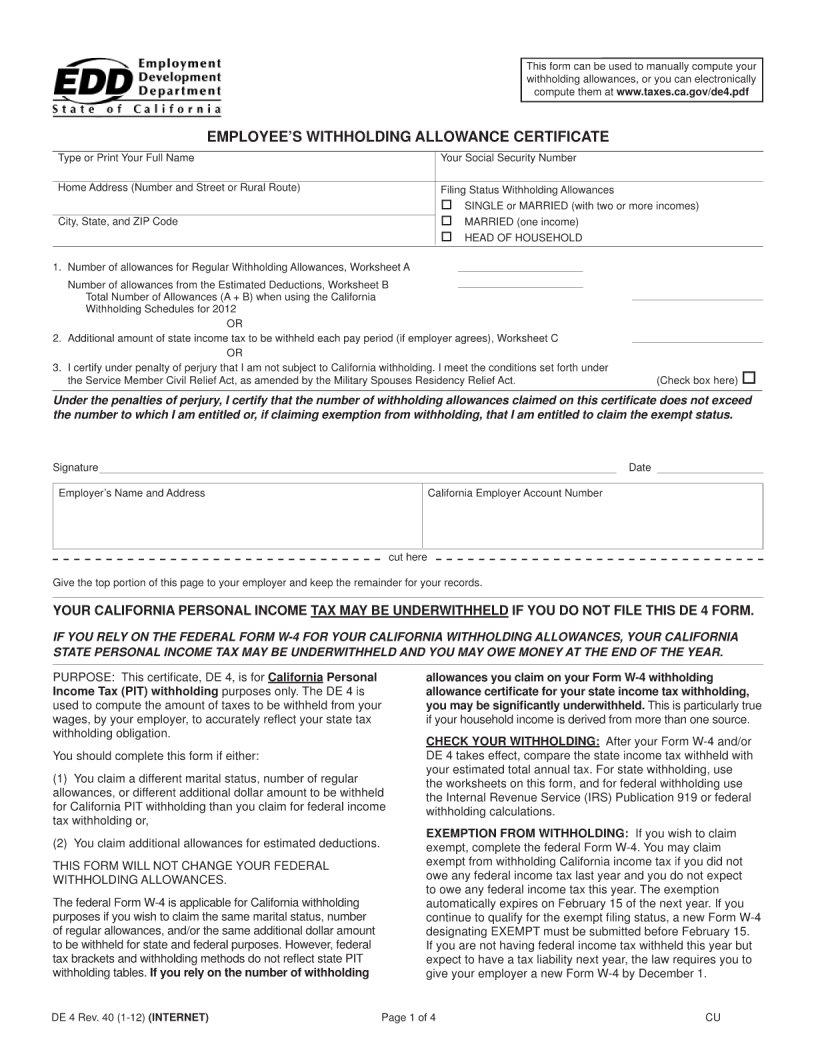

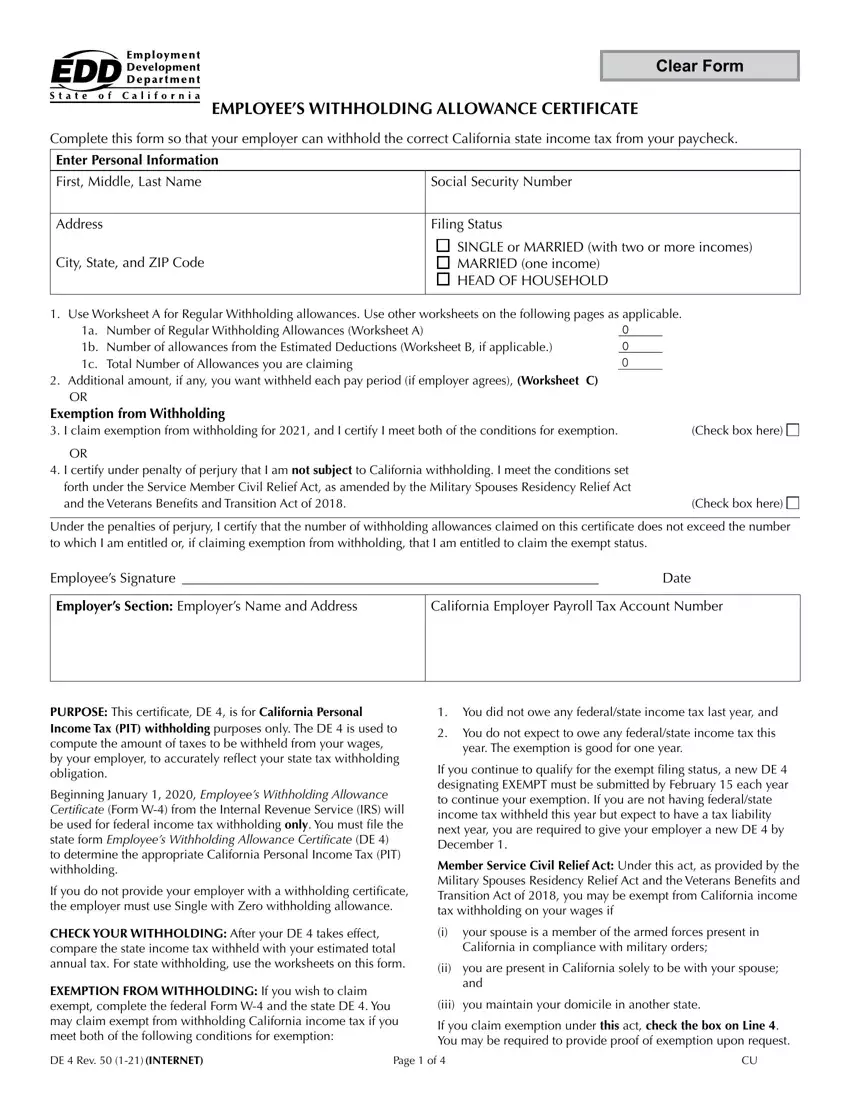

How Many Allowances Should I Claim on California's DE4 Form?

The information you supply must be. The de 4 is used to compute the amount of taxes to be withheld from your wages,. California personal income tax (pit) withholding purposes only. Keep the bottom portion for your records. You simply enter your personal details, claim the correct number of withholding.

De4 form Fill out & sign online DocHub

The information you supply must be. Keep the bottom portion for your records. California personal income tax (pit) withholding purposes only. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: You simply enter your personal details, claim the correct number of withholding.

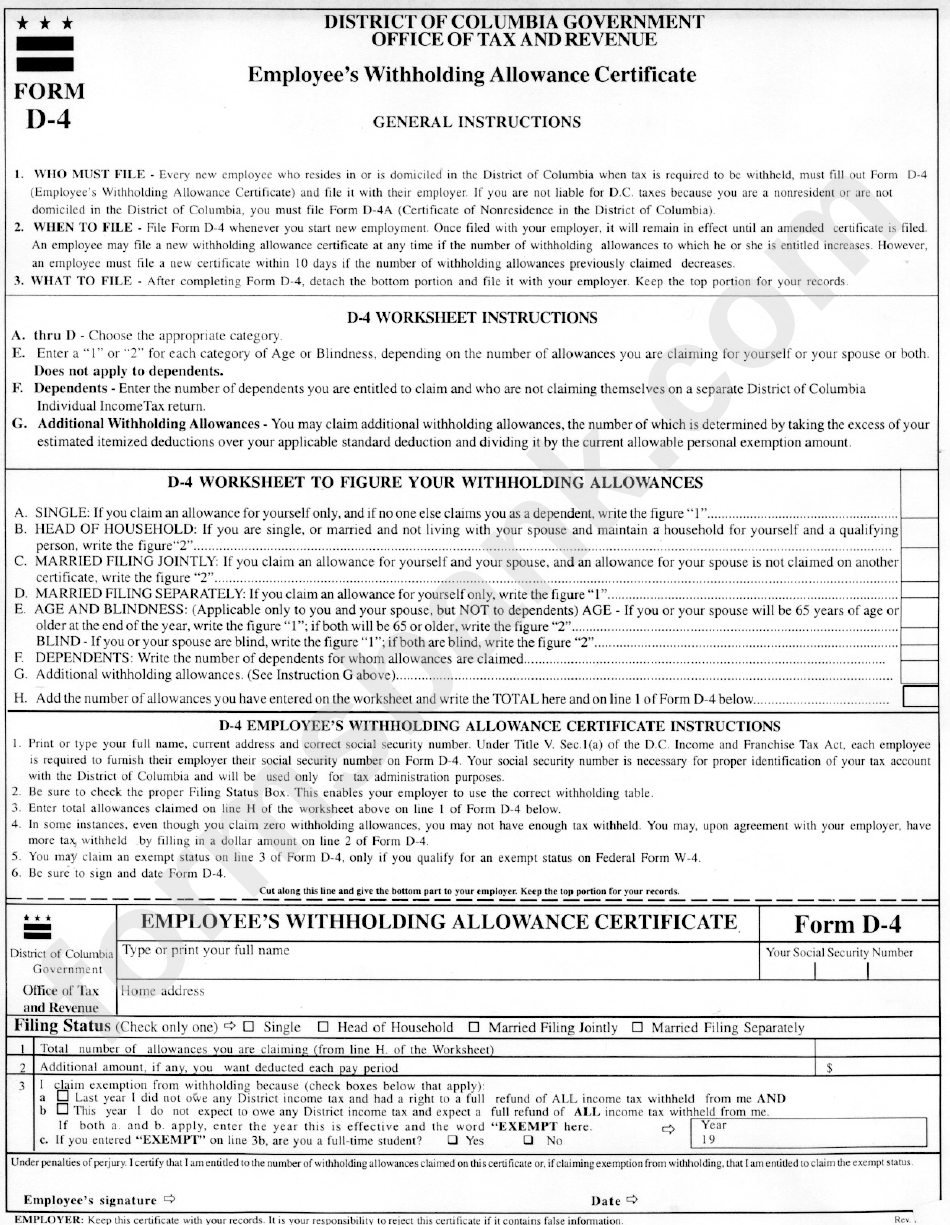

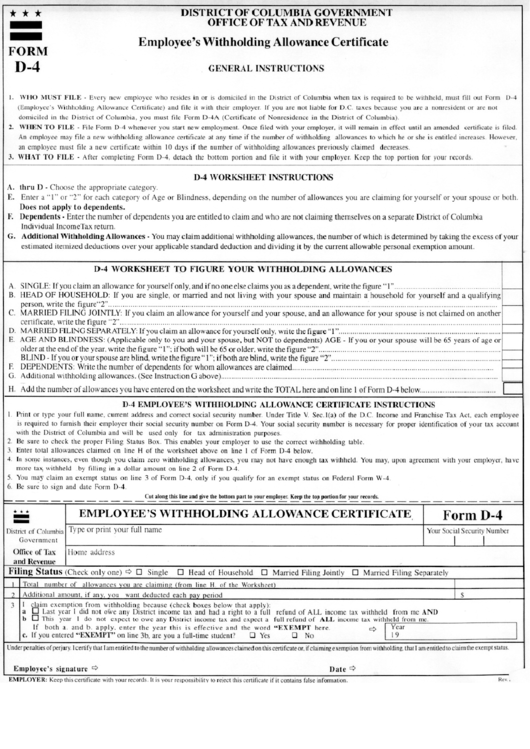

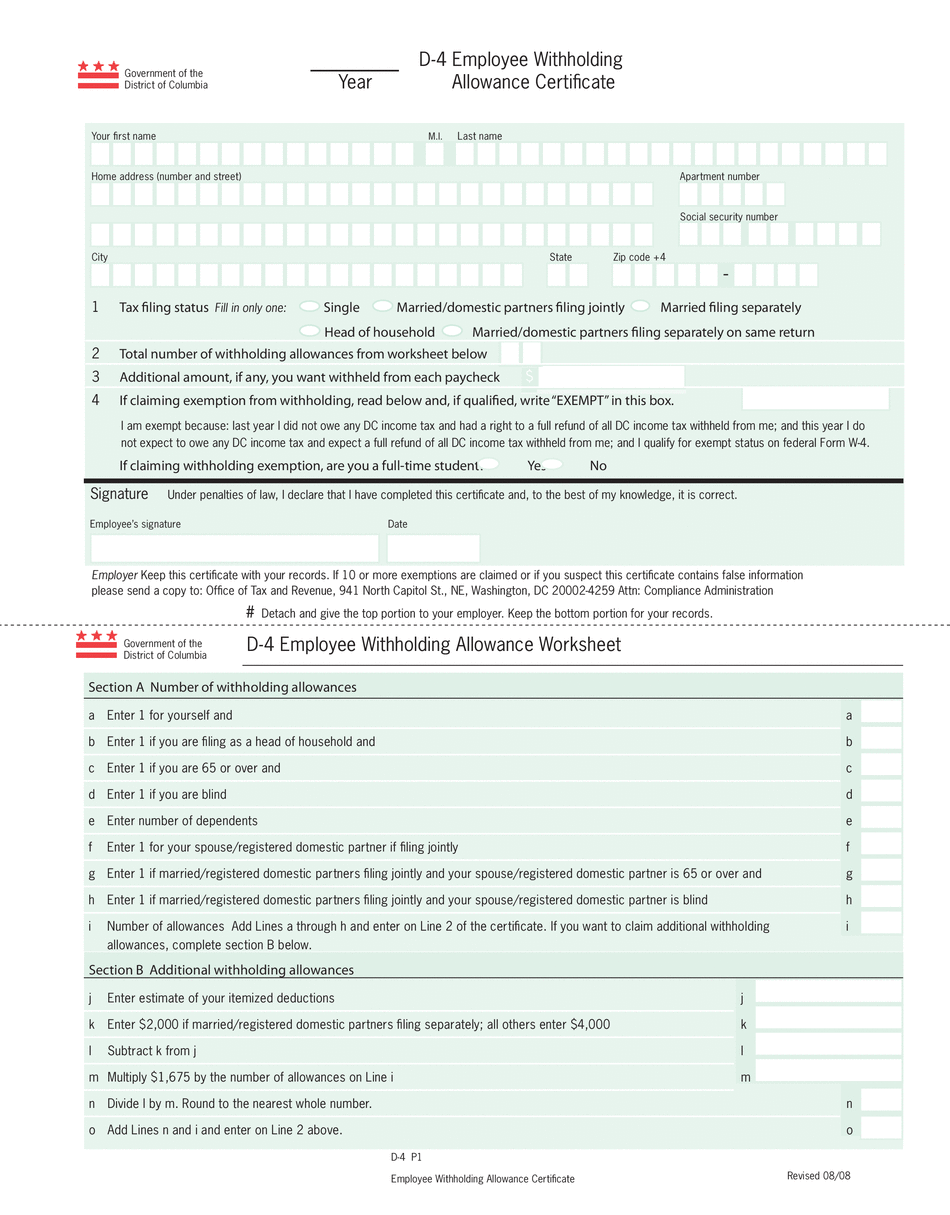

Form D4 Employee'S Withholding Allowance Certificate printable pdf

The de 4 is used to compute the amount of taxes to be withheld from your wages,. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: The information you supply must be. Keep the bottom portion for your records. California personal income tax (pit) withholding purposes only.

Form D4 Employee'S Withholding Allowance Certificate printable pdf

California personal income tax (pit) withholding purposes only. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: You simply enter your personal details, claim the correct number of withholding. Keep the bottom portion for your records. The de 4 is used to compute the amount of taxes to be withheld from your wages,.

Free irs w4 worksheet, Download Free irs w4 worksheet png images, Free

You simply enter your personal details, claim the correct number of withholding. The information you supply must be. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: Keep the bottom portion for your records. California personal income tax (pit) withholding purposes only.

Ca De 4 Form ≡ Fill Out Printable PDF Forms Online

Box 2396 annapolis, md 21404 federal employer identification number (ein) important: The de 4 is used to compute the amount of taxes to be withheld from your wages,. California personal income tax (pit) withholding purposes only. Keep the bottom portion for your records. You simply enter your personal details, claim the correct number of withholding.

W 4 Printable 20182025 Form Fill Out and Sign Printable PDF Template

California personal income tax (pit) withholding purposes only. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: The information you supply must be. The de 4 is used to compute the amount of taxes to be withheld from your wages,. Keep the bottom portion for your records.

California De4 Form Printable Vocabulary Flashcards

Keep the bottom portion for your records. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: California personal income tax (pit) withholding purposes only. You simply enter your personal details, claim the correct number of withholding. The information you supply must be.

California Form De 4 ≡ Fill Out Printable PDF Forms Online

The de 4 is used to compute the amount of taxes to be withheld from your wages,. You simply enter your personal details, claim the correct number of withholding. The information you supply must be. Box 2396 annapolis, md 21404 federal employer identification number (ein) important: California personal income tax (pit) withholding purposes only.

The De 4 Is Used To Compute The Amount Of Taxes To Be Withheld From Your Wages,.

Box 2396 annapolis, md 21404 federal employer identification number (ein) important: Keep the bottom portion for your records. California personal income tax (pit) withholding purposes only. You simply enter your personal details, claim the correct number of withholding.