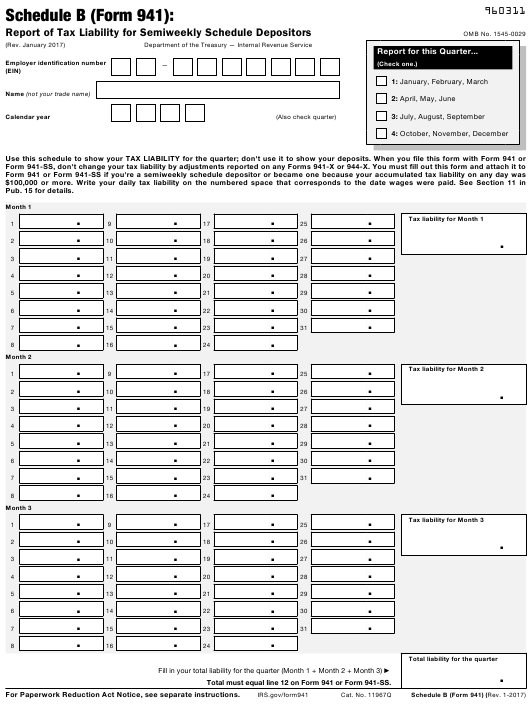

941 Tax Form Schedule B - When you file this schedule with form 941, don’t change. Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. Learn how to properly complete schedule b form 941 for quarterly tax deposits. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Don’t use it to show your deposits. Use this schedule to show your tax liability for the quarter;

Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Use this schedule to show your tax liability for the quarter; Don’t use it to show your deposits. Learn how to properly complete schedule b form 941 for quarterly tax deposits. When you file this schedule with form 941, don’t change.

Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. When you file this schedule with form 941, don’t change. Don’t use it to show your deposits. Use this schedule to show your tax liability for the quarter; Learn how to properly complete schedule b form 941 for quarterly tax deposits.

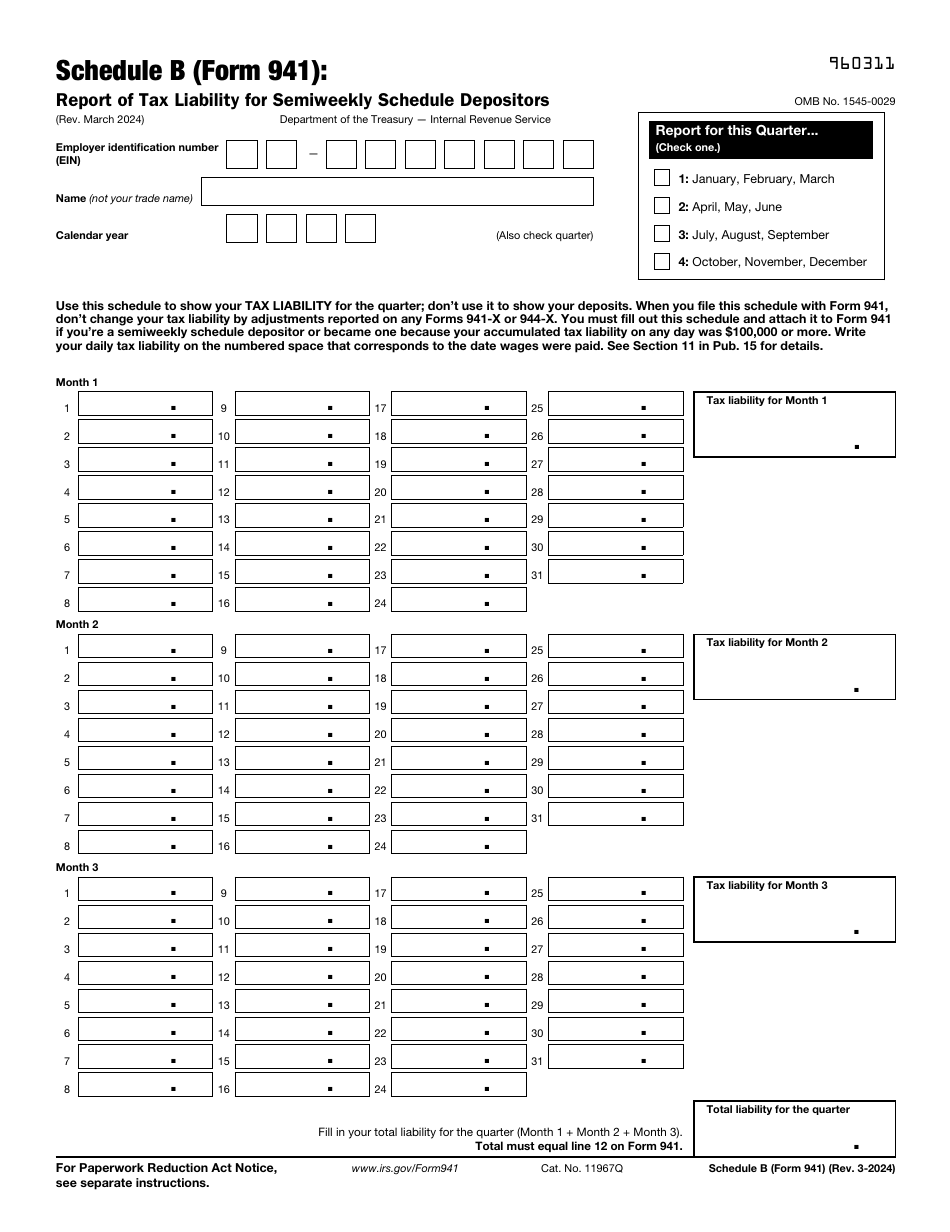

Irs 2024 Schedule B 941 carly maudie

When you file this schedule with form 941, don’t change. Learn how to properly complete schedule b form 941 for quarterly tax deposits. Use this schedule to show your tax liability for the quarter; Don’t use it to show your deposits. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time.

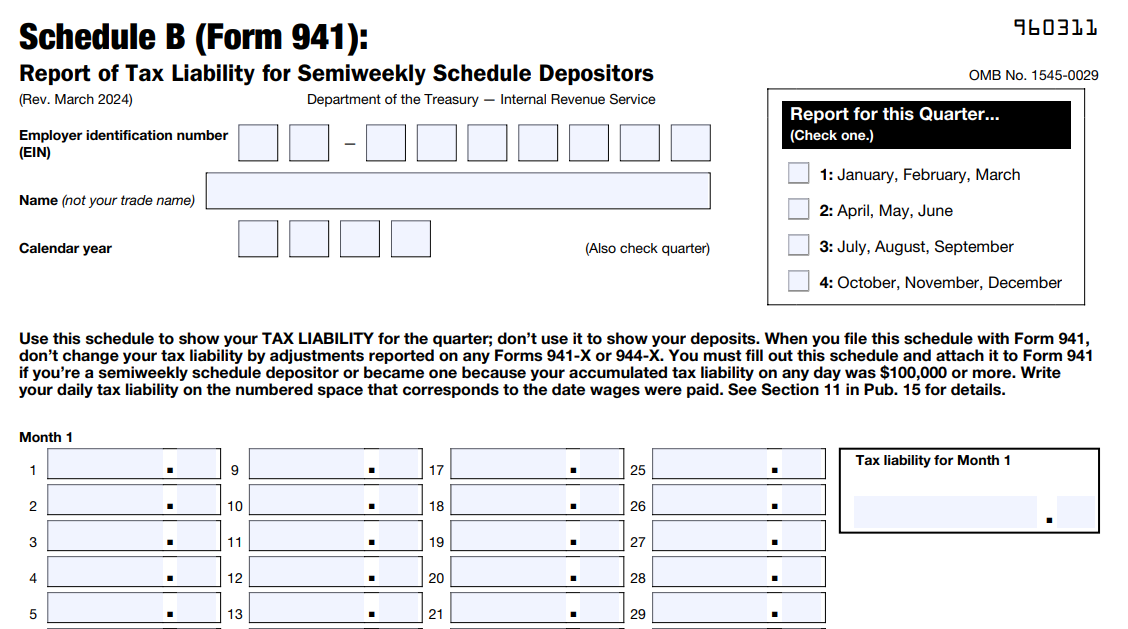

Irs Form 941 Instructions 2024 Dot Shelbi

Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. When you file this schedule with form 941, don’t change. Don’t use it to show your deposits. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Use this.

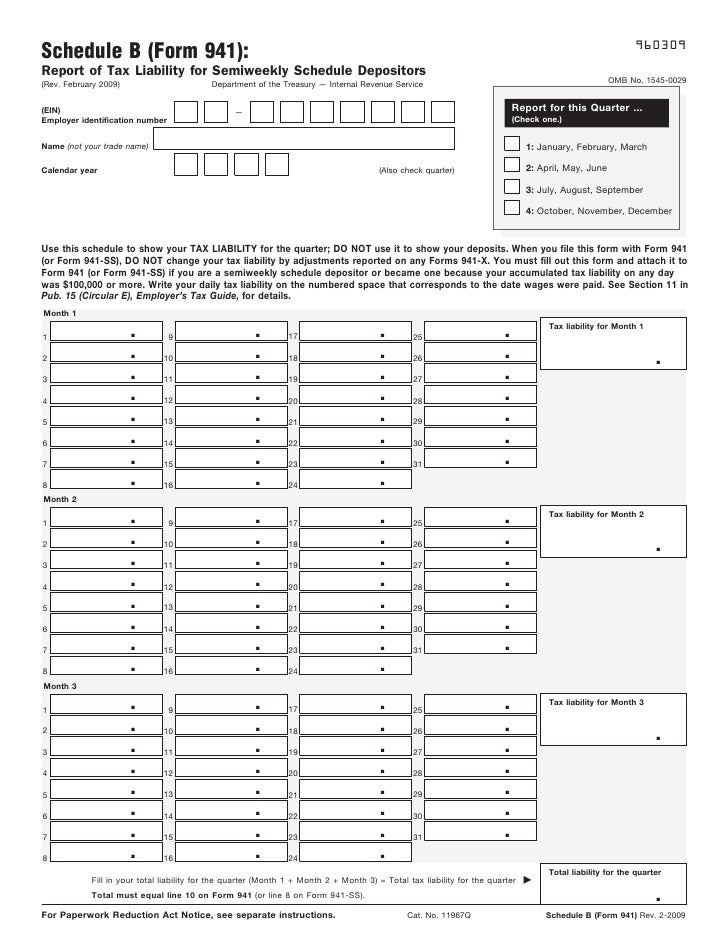

Form 941 (Schedule B) Report of Tax Liability for Semiweekly Schedul…

Use this schedule to show your tax liability for the quarter; When you file this schedule with form 941, don’t change. Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities.

IRS Form 941 Schedule B Fill Out, Sign Online and Download Fillable

Use this schedule to show your tax liability for the quarter; Don’t use it to show your deposits. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. When.

IRS 941 Schedule B 20172022 Fill and Sign Printable Template

The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. When you file this schedule with form 941, don’t change. Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. Don’t use it to show your deposits. Learn how.

IRS Form 941 Schedule B for 2024 Semi Weekly Schedule Depositor

When you file this schedule with form 941, don’t change. Don’t use it to show your deposits. Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Use this.

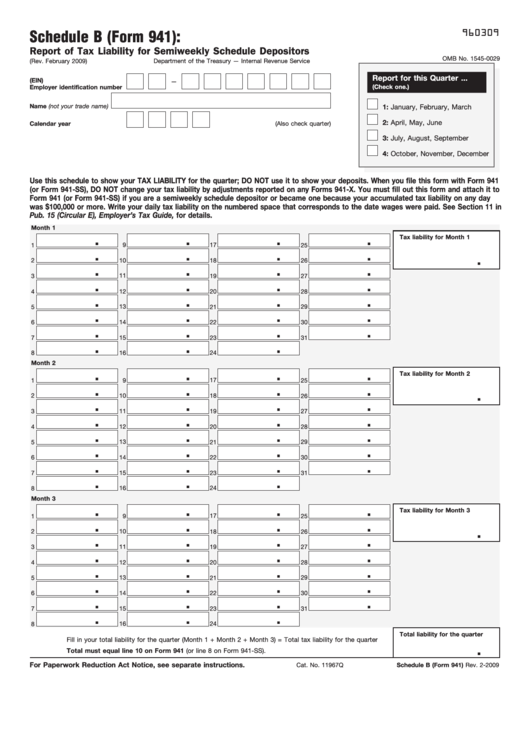

Form 941 Schedule B 2025 Cruz Reed

Learn how to properly complete schedule b form 941 for quarterly tax deposits. Use this schedule to show your tax liability for the quarter; When you file this schedule with form 941, don’t change. Don’t use it to show your deposits. Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer.

Schedule B 941 Form 2024 Josey Mallory

Don’t use it to show your deposits. Use this schedule to show your tax liability for the quarter; The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. When.

Schedule B Form 941 2025 Mailing Elijah David

Use this schedule to show your tax liability for the quarter; When you file this schedule with form 941, don’t change. Learn how to properly complete schedule b form 941 for quarterly tax deposits. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. Schedule b is an attachment to form 941 that.

2023 941 schedule b Fill out & sign online DocHub

Don’t use it to show your deposits. Schedule b is an attachment to form 941 that provides detailed information on the tax liabilities of an employer for each month of the. Learn how to properly complete schedule b form 941 for quarterly tax deposits. Use this schedule to show your tax liability for the quarter; The irs uses schedule b.

Use This Schedule To Show Your Tax Liability For The Quarter;

Don’t use it to show your deposits. Learn how to properly complete schedule b form 941 for quarterly tax deposits. The irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time. When you file this schedule with form 941, don’t change.