5013C Form - Find and check a charity using candid's guidestar. Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? What is a 501 (c) (3) organization? Section 501 (c) (3) is a portion of the u.s. Internal revenue code (irc) and a specific tax category. Learn the difference, the benefits of 501 (c) (3) status, and how to start your nonprofit the. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal. Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit.

Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? Learn the difference, the benefits of 501 (c) (3) status, and how to start your nonprofit the. What is a 501 (c) (3) organization? A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal. Internal revenue code (irc) and a specific tax category. Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit. Section 501 (c) (3) is a portion of the u.s. Find and check a charity using candid's guidestar.

What is a 501 (c) (3) organization? Find and check a charity using candid's guidestar. Internal revenue code (irc) and a specific tax category. Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit. Section 501 (c) (3) is a portion of the u.s. Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal. Learn the difference, the benefits of 501 (c) (3) status, and how to start your nonprofit the.

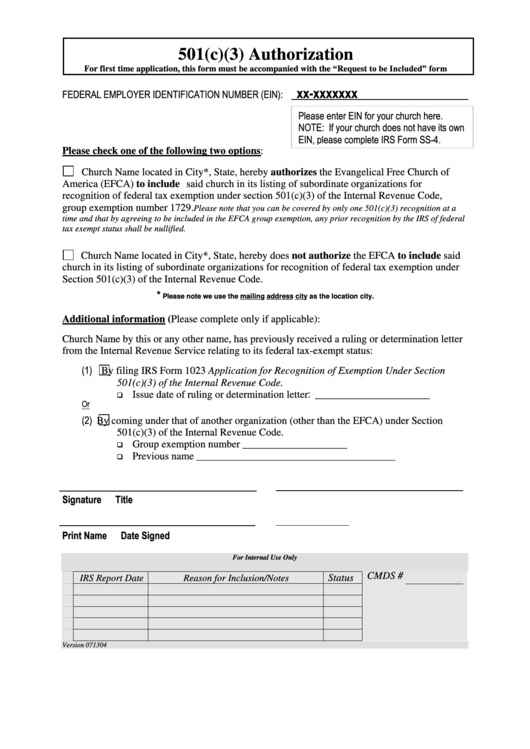

501 C 3 Document Form

Find and check a charity using candid's guidestar. What is a 501 (c) (3) organization? Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit. Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? Internal revenue code (irc) and a specific tax category.

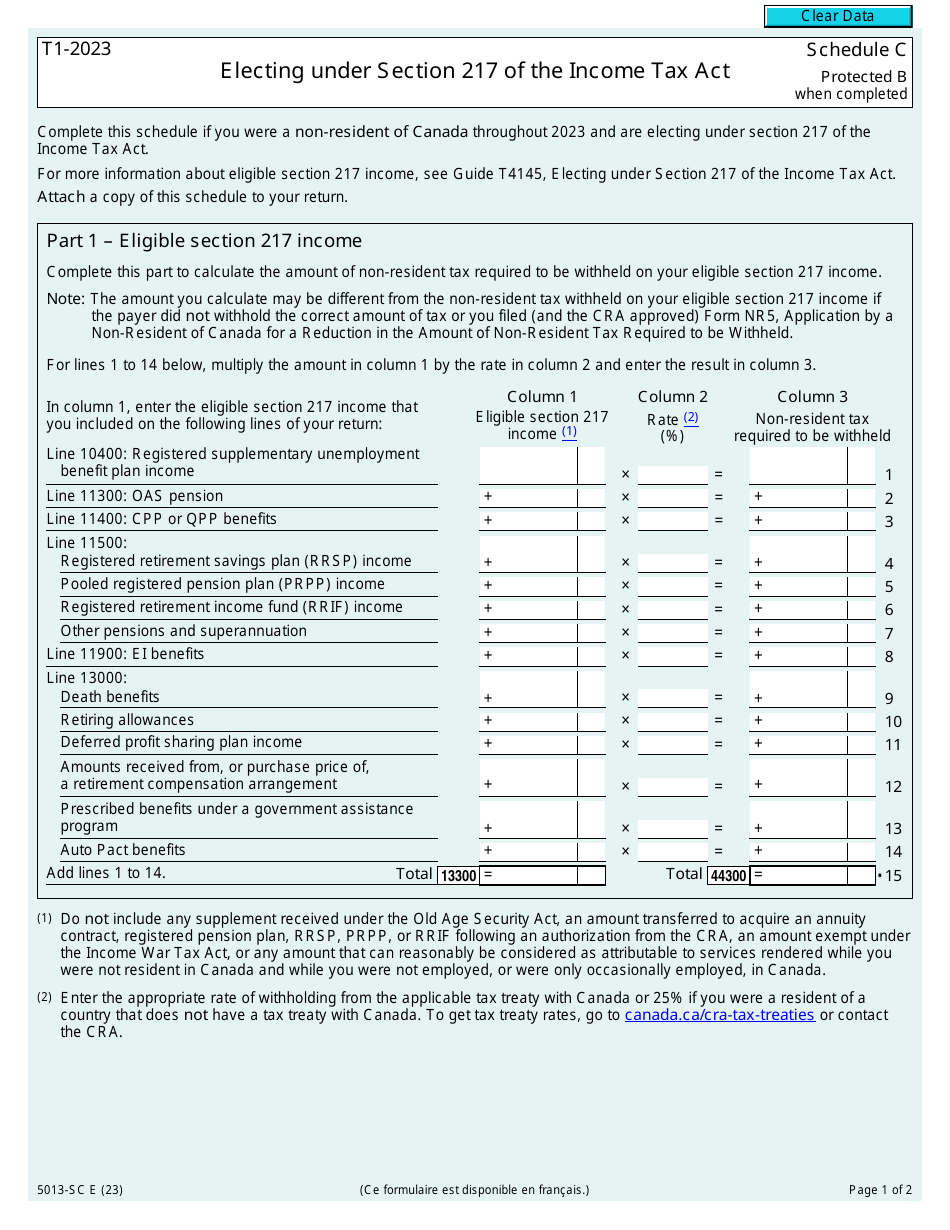

Form 5013SC Schedule C 2023 Fill Out, Sign Online and Download

Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit. Find and check a charity using candid's guidestar. Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? Section 501 (c) (3) is a portion of the u.s. Internal revenue code (irc) and a specific tax category.

Top 501c3 Form Templates free to download in PDF format

Section 501 (c) (3) is a portion of the u.s. Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit. Internal revenue code (irc) and a specific tax category. Find and check a charity using candid's guidestar. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization.

Receipt Template For 501 C Donation Fabulous Receipt Forms

A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal. Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? What is a 501 (c) (3) organization? Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit. Learn the difference, the benefits of.

Form 1023EZ The Faster, Easier 501(c)(3) Application for Small

Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? Section 501 (c) (3) is a portion of the u.s. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal. Learn the difference, the benefits of 501 (c) (3) status, and how to start your nonprofit the. What.

Application Process for Seeking 501(c)(3) TaxExempt Status UNT

A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal. Learn the difference, the benefits of 501 (c) (3) status, and how to start your nonprofit the. Find and check a charity using candid's guidestar. What is a 501 (c) (3) organization? Internal revenue code (irc) and a specific.

Tax Forms For 501c3 Organizations Form Resume Examples lV8NeRg30o

Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit. Learn the difference, the benefits of 501 (c) (3) status, and how to start your nonprofit the. What is a 501 (c) (3) organization? A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal..

Tax Day Approaches for Nonprofits 501(c) Services

Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit. Internal revenue code (irc) and a specific tax category. Section 501 (c) (3) is a portion of the u.s. What is a 501 (c) (3) organization? Learn the difference, the benefits of 501 (c) (3) status, and how to start your nonprofit the.

501c3.Guidelines issued by the IRS Irs Tax Forms 501(C) Organization

Internal revenue code (irc) and a specific tax category. Look up 501 (c) (3) status, search 990s, create nonprofit organizations lists, and verify nonprofit. Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? Section 501 (c) (3) is a portion of the u.s. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other.

Donation to 501(c)(3) Organization, 501(c)(3) Donation Template, 501

Learn the difference, the benefits of 501 (c) (3) status, and how to start your nonprofit the. Section 501 (c) (3) is a portion of the u.s. Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal. What.

Section 501 (C) (3) Is A Portion Of The U.s.

A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal. What is a 501 (c) (3) organization? Confused by 5013c, 501c, 501 c 3, or 501 (c) (3)? Internal revenue code (irc) and a specific tax category.

Look Up 501 (C) (3) Status, Search 990S, Create Nonprofit Organizations Lists, And Verify Nonprofit.

Find and check a charity using candid's guidestar. Learn the difference, the benefits of 501 (c) (3) status, and how to start your nonprofit the.