162 Simplest Radical Form - Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Discover the essentials of irs code 162 (a) for maximizing business deductions. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Learn the intricacies of 'ordinary and necessary' expenses,.

For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Discover the essentials of irs code 162 (a) for maximizing business deductions. Learn the intricacies of 'ordinary and necessary' expenses,.

For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Learn the intricacies of 'ordinary and necessary' expenses,. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Discover the essentials of irs code 162 (a) for maximizing business deductions.

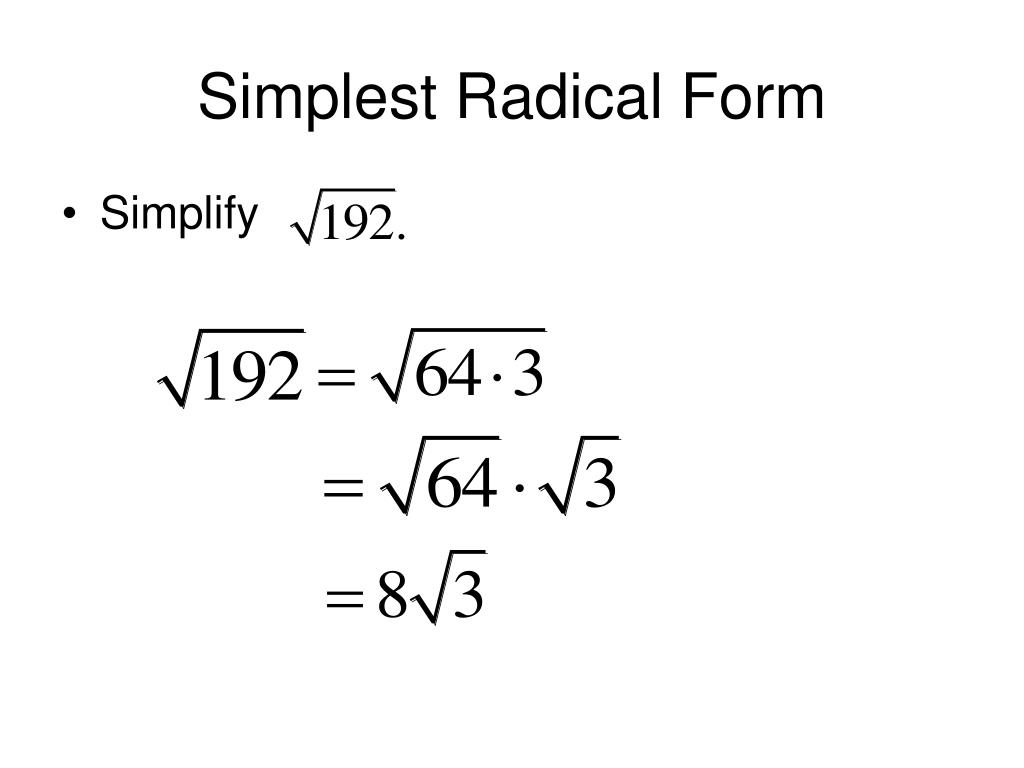

Simplest Radical Form

Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Discover the essentials of irs code 162 (a) for maximizing business deductions. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if.

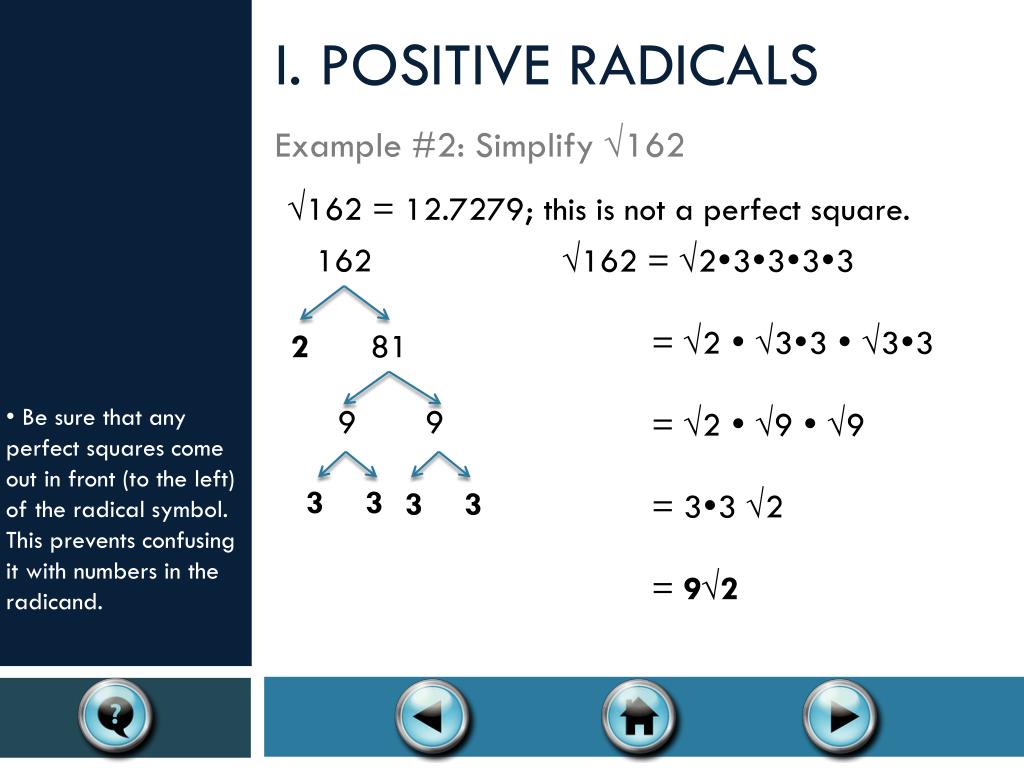

What Is the Square Root of 162 in Radical Form WendyhasCollier

For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Discover the essentials of irs code 162 (a) for maximizing business deductions. Learn the intricacies of 'ordinary and necessary' expenses,. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot.

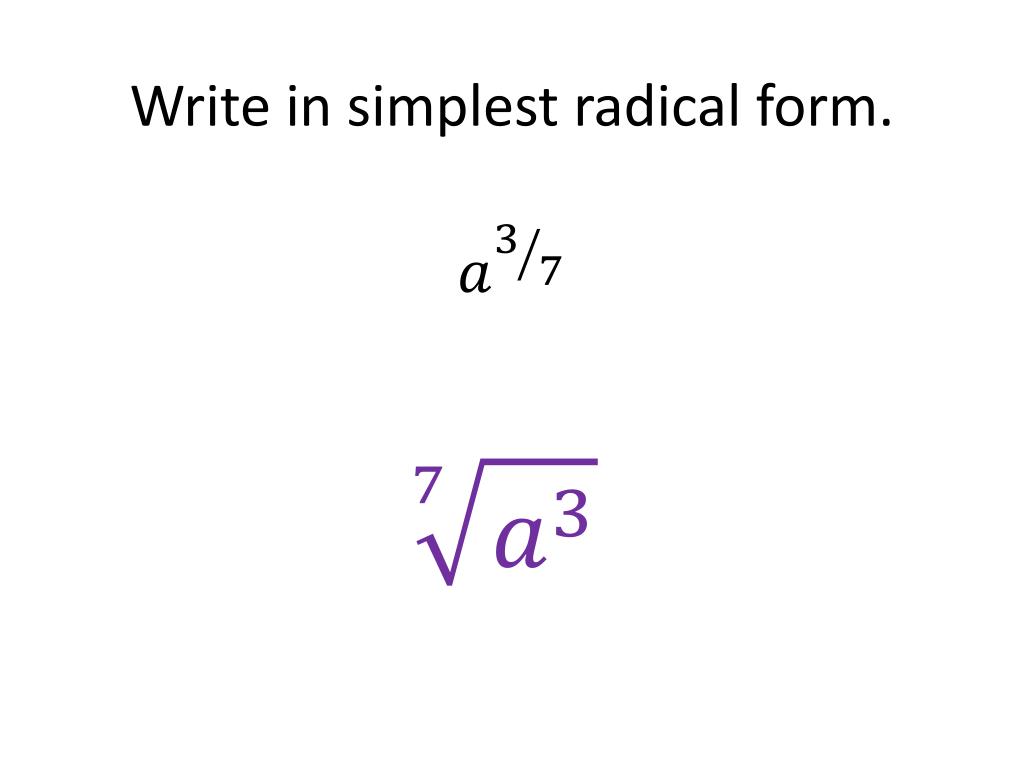

Properties of Rational Exponents and Radicals ppt video online download

Learn the intricacies of 'ordinary and necessary' expenses,. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Discover the essentials of irs code 162 (a) for maximizing business deductions. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot.

Simplified Radical Form

Discover the essentials of irs code 162 (a) for maximizing business deductions. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. For.

PPT Simplifying Radicals PowerPoint Presentation, free download ID

Discover the essentials of irs code 162 (a) for maximizing business deductions. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Learn the intricacies of 'ordinary and necessary' expenses,. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary.

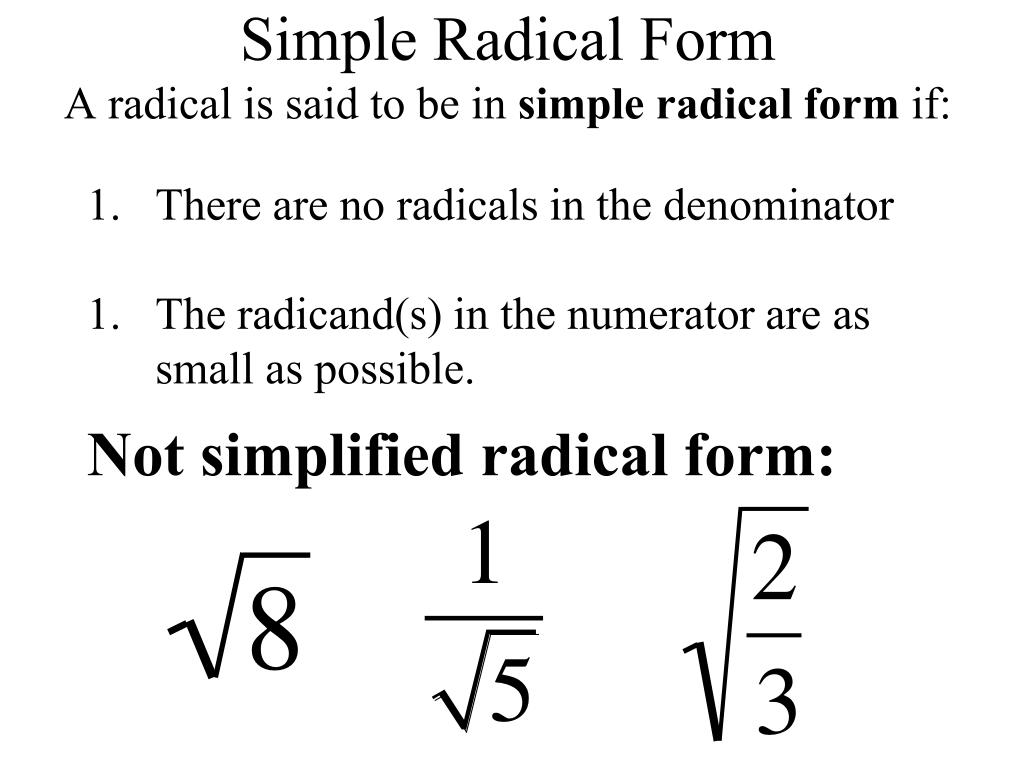

Simplest Radical Form Formula

Learn the intricacies of 'ordinary and necessary' expenses,. Discover the essentials of irs code 162 (a) for maximizing business deductions. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses.

PPT 8.1 Pythagorean Theorem and Its Converse PowerPoint Presentation

Discover the essentials of irs code 162 (a) for maximizing business deductions. Learn the intricacies of 'ordinary and necessary' expenses,. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away.

Simplest Radical Form

For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period. Learn the intricacies of 'ordinary and necessary' expenses,. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Discover the.

Unit 1 Algebra 2 CP Radicals. ppt download

Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Discover the essentials of irs code 162 (a) for maximizing business deductions. Learn.

These numbers are called the Perfect Squares. ppt download

Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. For purposes of paragraph (2), the taxpayer shall not be treated as being.

Learn The Intricacies Of 'Ordinary And Necessary' Expenses,.

Discover the essentials of irs code 162 (a) for maximizing business deductions. Blue jays, guardians secure division titles, reds surge past mets for final nl playoff spot the final day of the 2025 major. Section 162 of the internal revenue code (irc) allows you to deduct all the ordinary and necessary expenses you incur during the taxable year in. For purposes of paragraph (2), the taxpayer shall not be treated as being temporarily away from home during any period of employment if such period.