1120S Form K-1 - In turbo tax business 1120s for 2022, where to i put a shareholders loan shouldn't this reduce income? I made the mistake of not reimbursing, but claiming a deduction on my 1120s for business mileage from 2016 to 2019. I know that for the s corp i need to file form 1120s and that i will in turn receive a k1 which i will use to file schedule e on my personal 1140. It is this information from. 1m+ visitors in the past month I’ve done the 1120s online last year on turbotax business online. Did you ever get the 1120s figured out? Where can i find it? I read this on the irs website but can't find the form. Use the simplified method ($5 / sq foot) on 1120s or schedule c?.

1m+ visitors in the past month In turbo tax business 1120s for 2022, where to i put a shareholders loan shouldn't this reduce income? I’ve done the 1120s online last year on turbotax business online. I read this on the irs website but can't find the form. This year i login and. I know that for the s corp i need to file form 1120s and that i will in turn receive a k1 which i will use to file schedule e on my personal 1140. If a married couple files 1120s, how to get the home office deduction? Use the simplified method ($5 / sq foot) on 1120s or schedule c?. Did you ever get the 1120s figured out? I made the mistake of not reimbursing, but claiming a deduction on my 1120s for business mileage from 2016 to 2019.

I read this on the irs website but can't find the form. Did you ever get the 1120s figured out? I made the mistake of not reimbursing, but claiming a deduction on my 1120s for business mileage from 2016 to 2019. This year i login and. It is this information from. 1m+ visitors in the past month In turbo tax business 1120s for 2022, where to i put a shareholders loan shouldn't this reduce income? I know that for the s corp i need to file form 1120s and that i will in turn receive a k1 which i will use to file schedule e on my personal 1140. In 2020, my s corp. Use the simplified method ($5 / sq foot) on 1120s or schedule c?.

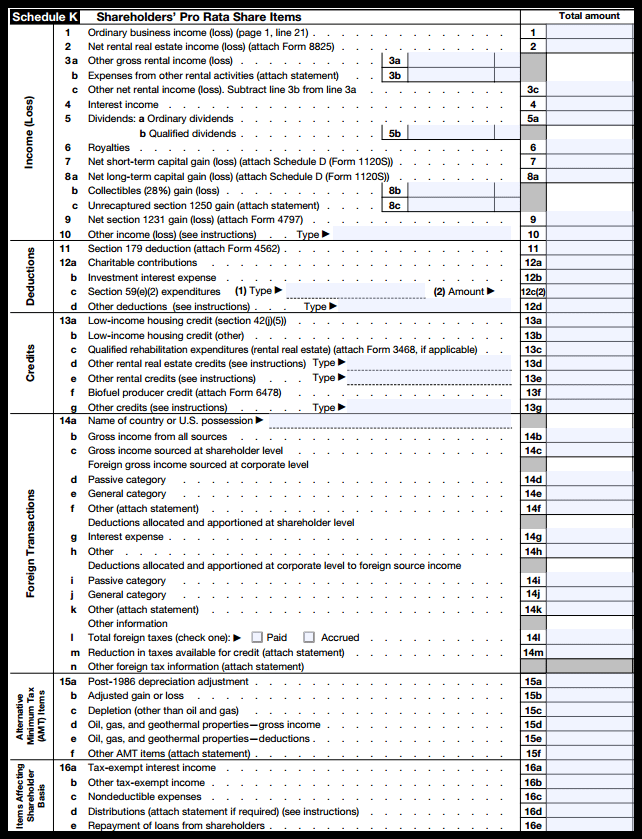

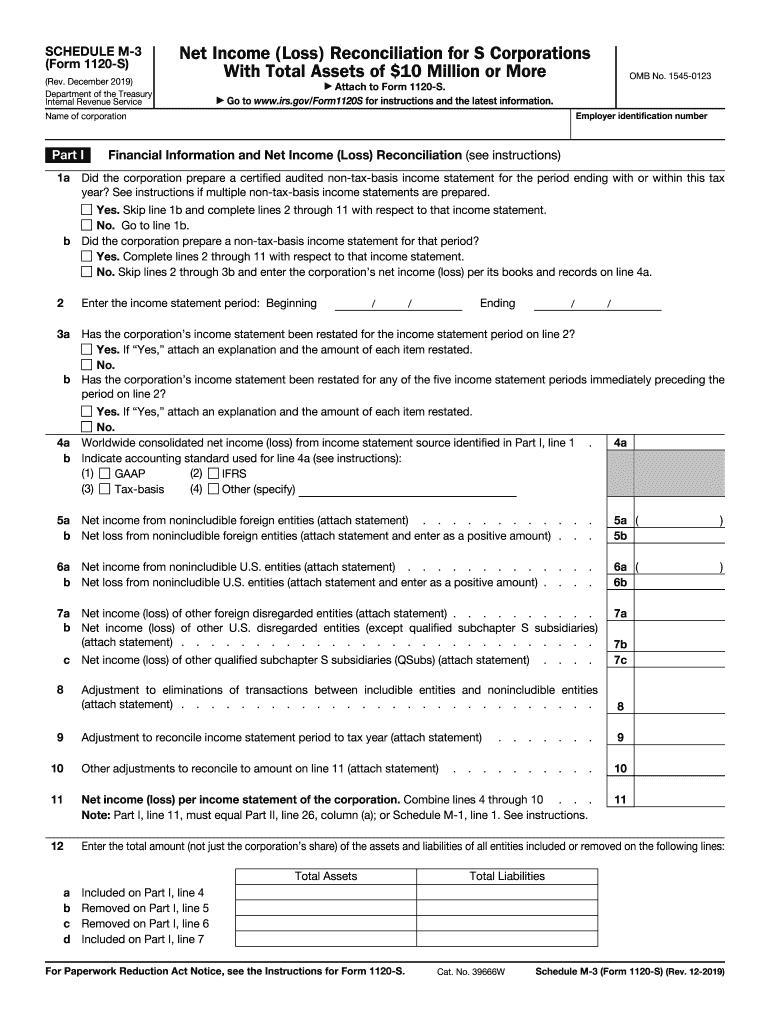

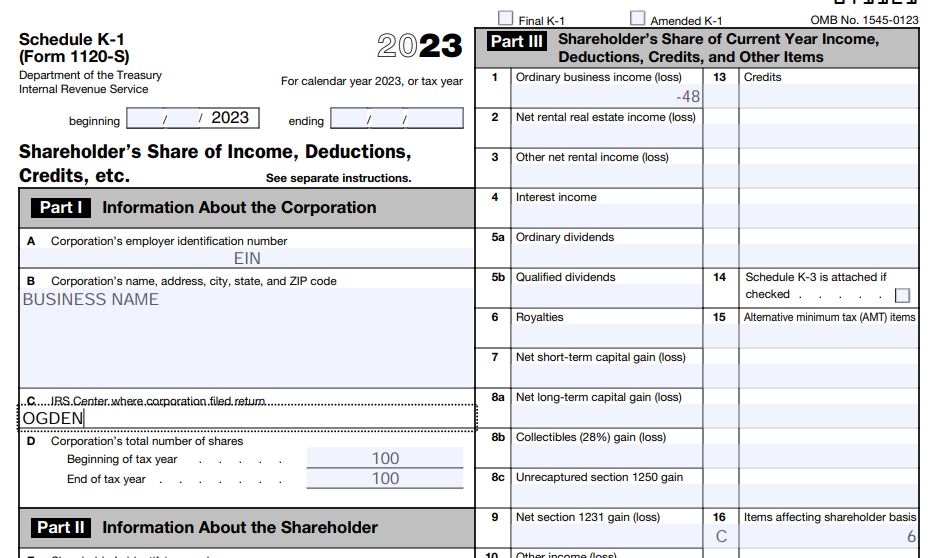

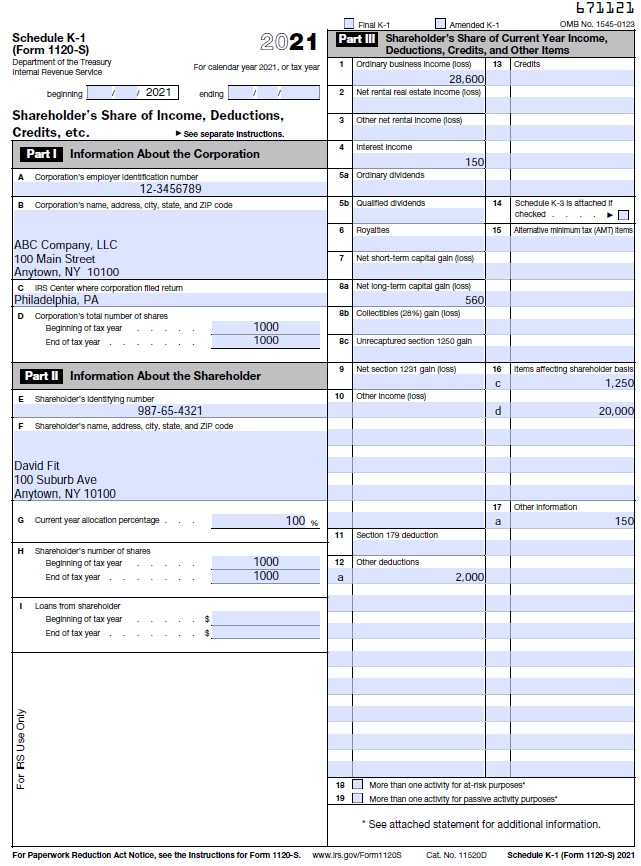

Schedule K1 Form 1120s Instructions 2025 Piper Underhills

In 2020, my s corp. In turbo tax business 1120s for 2022, where to i put a shareholders loan shouldn't this reduce income? Did you ever get the 1120s figured out? This year i login and. I’ve done the 1120s online last year on turbotax business online.

I need help with Schedule K1 (Form 1120S) for John Parsons and

Did you ever get the 1120s figured out? I’ve done the 1120s online last year on turbotax business online. It is this information from. 1m+ visitors in the past month Where can i find it?

2025 Schedule K1 1120s Mary M. Stern

This year i login and. I know that for the s corp i need to file form 1120s and that i will in turn receive a k1 which i will use to file schedule e on my personal 1140. In 2020, my s corp. If a married couple files 1120s, how to get the home office deduction? Use the simplified.

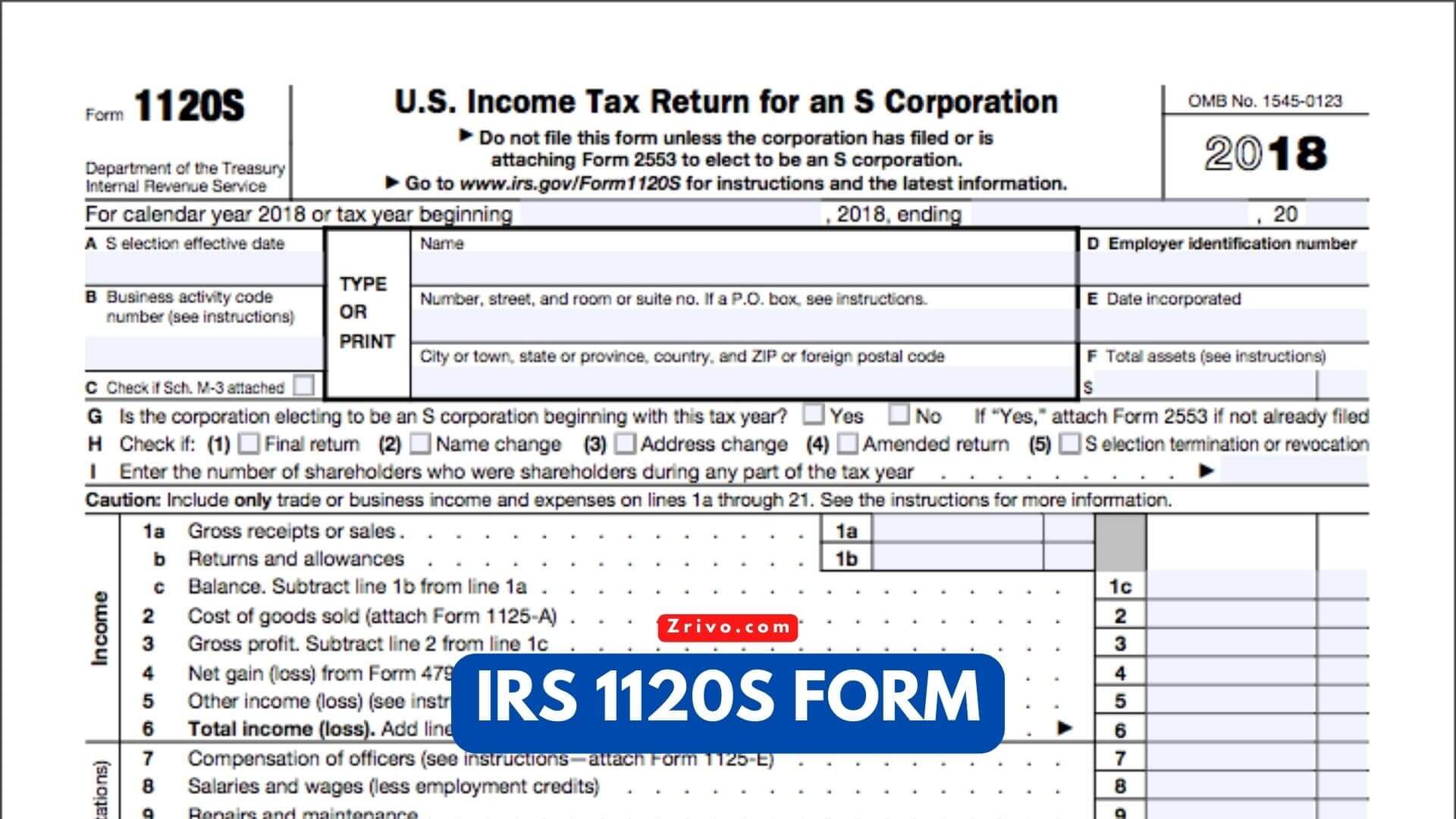

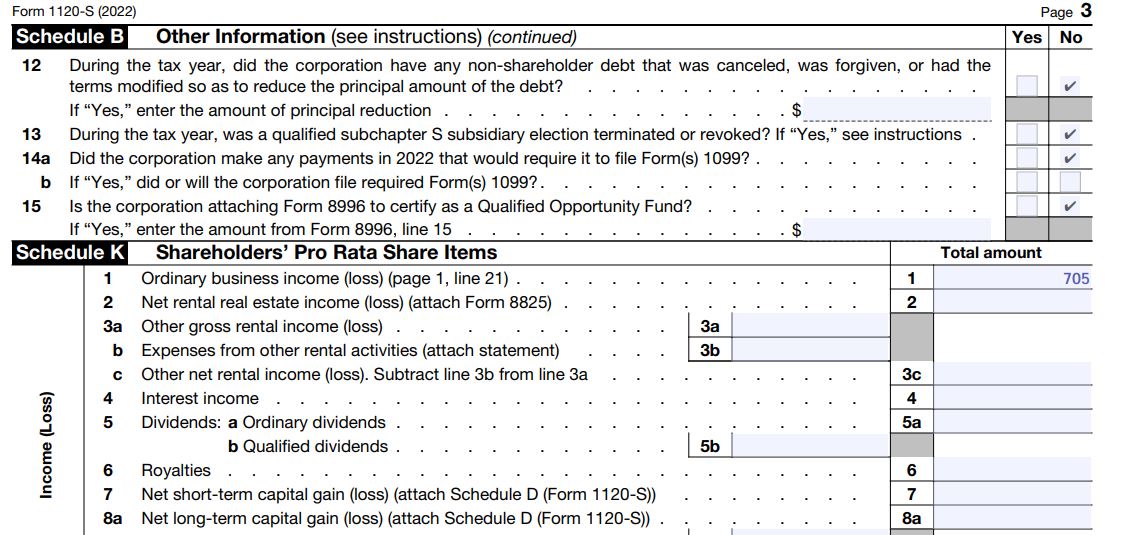

Form 1120 s Fill out & sign online DocHub

Where can i find it? It is this information from. In 2020, my s corp. I’ve done the 1120s online last year on turbotax business online. I know that for the s corp i need to file form 1120s and that i will in turn receive a k1 which i will use to file schedule e on my personal 1140.

1120S Form 2024 2025

I made the mistake of not reimbursing, but claiming a deduction on my 1120s for business mileage from 2016 to 2019. It is this information from. If a married couple files 1120s, how to get the home office deduction? Use the simplified method ($5 / sq foot) on 1120s or schedule c?. Where can i find it?

[Solved] I need assistance with answering Schedule K1 (Form 1120S

Where can i find it? If a married couple files 1120s, how to get the home office deduction? 1m+ visitors in the past month I’ve done the 1120s online last year on turbotax business online. In 2020, my s corp.

How to fill out Form 1120S and Schedule K1 for 2023 S Corporation

If a married couple files 1120s, how to get the home office deduction? I made the mistake of not reimbursing, but claiming a deduction on my 1120s for business mileage from 2016 to 2019. In turbo tax business 1120s for 2022, where to i put a shareholders loan shouldn't this reduce income? It is this information from. I read this.

How to fill out Form 1120S and Schedule K1 for 2022 Nina's Soap

In turbo tax business 1120s for 2022, where to i put a shareholders loan shouldn't this reduce income? It is this information from. In 2020, my s corp. I made the mistake of not reimbursing, but claiming a deduction on my 1120s for business mileage from 2016 to 2019. If a married couple files 1120s, how to get the home.

How to Complete Form 1120S & Schedule K1 (With Sample)

I’ve done the 1120s online last year on turbotax business online. If a married couple files 1120s, how to get the home office deduction? Where can i find it? Use the simplified method ($5 / sq foot) on 1120s or schedule c?. 1m+ visitors in the past month

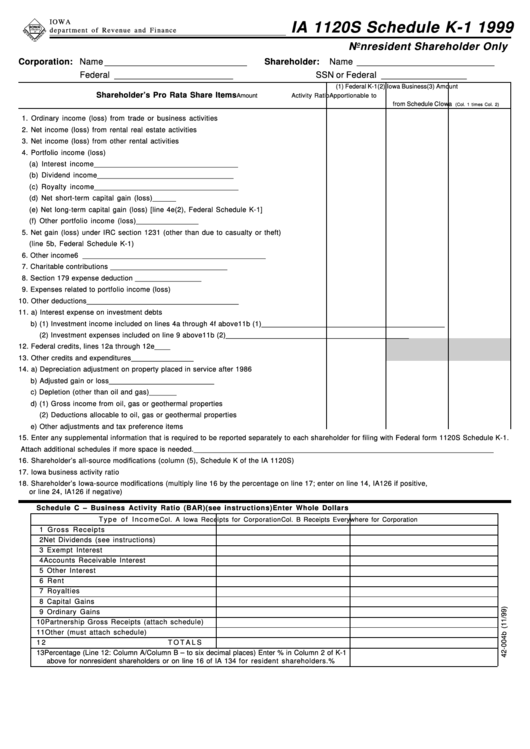

Form Ia 1120s Schedule K1 Nonresident Shareholder Only 1999

I made the mistake of not reimbursing, but claiming a deduction on my 1120s for business mileage from 2016 to 2019. Did you ever get the 1120s figured out? This year i login and. Use the simplified method ($5 / sq foot) on 1120s or schedule c?. In 2020, my s corp.

I Read This On The Irs Website But Can't Find The Form.

Where can i find it? In 2020, my s corp. Use the simplified method ($5 / sq foot) on 1120s or schedule c?. This year i login and.

If A Married Couple Files 1120S, How To Get The Home Office Deduction?

In turbo tax business 1120s for 2022, where to i put a shareholders loan shouldn't this reduce income? I’ve done the 1120s online last year on turbotax business online. Did you ever get the 1120s figured out? I made the mistake of not reimbursing, but claiming a deduction on my 1120s for business mileage from 2016 to 2019.

I Know That For The S Corp I Need To File Form 1120S And That I Will In Turn Receive A K1 Which I Will Use To File Schedule E On My Personal 1140.

It is this information from. 1m+ visitors in the past month